Loan acquisition can often feel daunting, especially for physicians stepping into their careers. Understanding the specific requirements and nuances of a doctor loan is vital to ensure you secure the best possible terms. This checklist will guide you through the important steps you need to take, from financial documentation to lender qualifications, helping you navigate the path with confidence. By following this comprehensive guide, you can make informed decisions that will ultimately enhance your financial stability as a medical professional.

Understanding Doctor Loans

Before you begin on your journey to secure a home, it’s vital to understand the unique nature of doctor loans. These specialized loans cater specifically to medical professionals, recognizing the unique financial situation you may face as you start your career. They offer tailored solutions that can help you navigate the often complex world of mortgage financing.

What is a Doctor Loan?

Among the various financing options available, a doctor loan is specifically designed for physicians and medical professionals who may not have a traditional credit history or large down payment. It takes into account your potential earning power, offering you favorable terms that can simplify the home-buying process.

Key Benefits of Doctor Loans

After identifying the structure of doctor loans, it’s imperative to recognize the key benefits they offer to you as a physician. These loans often come with flexible qualification standards, lower down payment requirements, and better interest rates, ensuring that you have the necessary support to achieve your homeownership goals.

At the heart of doctor loans are benefits that align perfectly with your financial needs. You may enjoy the ability to secure a mortgage with little to no down payment, which saves you from draining your savings. Moreover, they often allow for higher loan amounts, accommodating the purchase of homes in a competitive market. Some lenders will also bypass private mortgage insurance (PMI) requirements, significantly reducing your monthly payments. This unique combination of benefits can make your transition into homeownership much smoother.

Eligibility Criteria

Now, understanding the eligibility criteria for a doctor loan is vital for you to navigate the application process effectively. Lenders typically look at factors such as your profession, credit history, and financial stability. By familiarizing yourself with these criteria, you can increase your chances of securing the financing you need for your medical career.

Professional Qualifications

Before applying for a doctor loan, it is important to ensure that your professional qualifications meet the lender’s requirements. Lenders often prefer borrowers who have completed their residency or specialized training. This status demonstrates your commitment to the medical profession and enhances your trustworthiness as a borrower.

Income Considerations

Along with your professional qualifications, your income plays a significant role in the loan approval process. Lenders will assess your earning potential and current income to determine your ability to repay the loan on time.

Consequently, it is important to provide documentation of your current salary and any future income projections. Many lenders take into account your anticipated earnings in your medical field, especially if you are nearing the end of your training. This information helps you present a strong financial profile, increasing your chances of securing favorable loan terms.

Preparing Your Financial Profile

Many physicians find that preparing a strong financial profile is key to successfully securing a doctor loan. This involves getting an accurate picture of your finances, which includes assessing your income, expenses, and existing debt. By organizing your financial information and ensuring all documents are in order, you can enhance your appeal to lenders and streamline the application process.

Credit Score Importance

An impressive credit score can significantly influence your ability to obtain a doctor loan. Lenders typically look for scores above 700, which reflect your creditworthiness and responsible financial management. Before applying, check your credit report for errors or potential improvements, as a healthy score may help you secure better interest rates and terms.

Debt-to-Income Ratio

Ratio is another crucial aspect lenders evaluate when considering your loan application. This number represents the percentage of your monthly income that goes toward paying off debt, including student loans, mortgages, and credit cards. A lower debt-to-income ratio signals to lenders that you have a favorable balance between your income and expenses, ultimately making you a more attractive candidate for a doctor loan.

This ratio can often determine how much you can borrow and at what terms. To improve your debt-to-income ratio, consider paying off existing debts or increasing your income, if possible. Lenders generally prefer a ratio below 43%, as this indicates that you can comfortably manage your existing obligations while taking on new debt. Having this figure in check not only enhances your chances of loan approval but also positions you to take on additional financial responsibilities with confidence.

The Application Process

Unlike traditional loans, the application process for a doctor loan is tailored specifically to your unique financial situation as a physician. Lenders understand the demands of medical training and often provide flexible terms and lower down payment options. However, it’s important to present your case effectively, showcasing your employment prospects and long-term earning potential to secure the best rates available.

Documentation Required

After collecting your personal and professional documents, you’ll be ready to submit your application. Typical documentation includes proof of income, your residency contract, a copy of your medical license, and tax returns. Having these documents organized will aid in the swift processing of your loan application and ensure that you meet the lender’s requirements.

Common Pitfalls to Avoid

Below are some common pitfalls that can hinder your loan application process. It’s important to avoid discrepancies in your financial documentation, as these can lead to delays or denials. Also, be cautious of applying for multiple loans simultaneously, which can negatively impact your credit score. Lastly, ensure that you fully understand the loan terms and fees involved, as unexpected costs can arise if you don’t do your due diligence.

Application issues can arise when you overlook important details or fail to communicate effectively with lenders. Being unprepared or disorganized with required documents will delay the approval process and can lead to missing out on favorable loan options. Clarifying your financial situation upfront and understanding the specific criteria for doctor loans will position you favorably. Stay proactive, and don’t hesitate to ask questions throughout the process to ensure you’re making informed decisions with your loan application.

Comparing Loan Options

Keep in mind that comparing loan options is necessary for finding the best fit for your financial situation. You’ll want to evaluate various factors, such as interest rates, repayment terms, and loan amounts. By doing thorough research, you can make an informed decision that aligns with your long-term financial goals.

| Interest Rates | Loan Terms |

| Fees | Loan Amounts |

| Monthly Payments | Prepayment Options |

Fixed vs. Variable Rates

Rates for fixed loans remain constant throughout the loan term, providing predictability in your monthly payments. In contrast, variable rates can fluctuate, depending on market conditions, which may lead to lower initial payments but potential increases over time. Assess your financial stability and risk tolerance to decide which option suits you best.

Comparing Lender Offers

One of the key steps in securing a doctor loan is comparing offers from different lenders. This will give you insight into which lenders provide the best terms and customer service. You should gather detailed information from each lender, focusing on interest rates and additional fees to make an informed decision.

| Lender A | Interest Rate: 3.5%, Fees: $1,000 |

| Lender B | Interest Rate: 3.75%, Fees: $500 |

| Lender C | Interest Rate: 3.4%, Fees: $1,200 |

Variable rates can be appealing due to their lower initial costs, but consider the potential for an increase over time. Assess the lender’s history and the stability of their variable rates as you compare offers to ensure you are making the most informed choice for your financial future.

| Initial Rate | Potential for Fluctuation |

| Market Influences | Max Rate Caps |

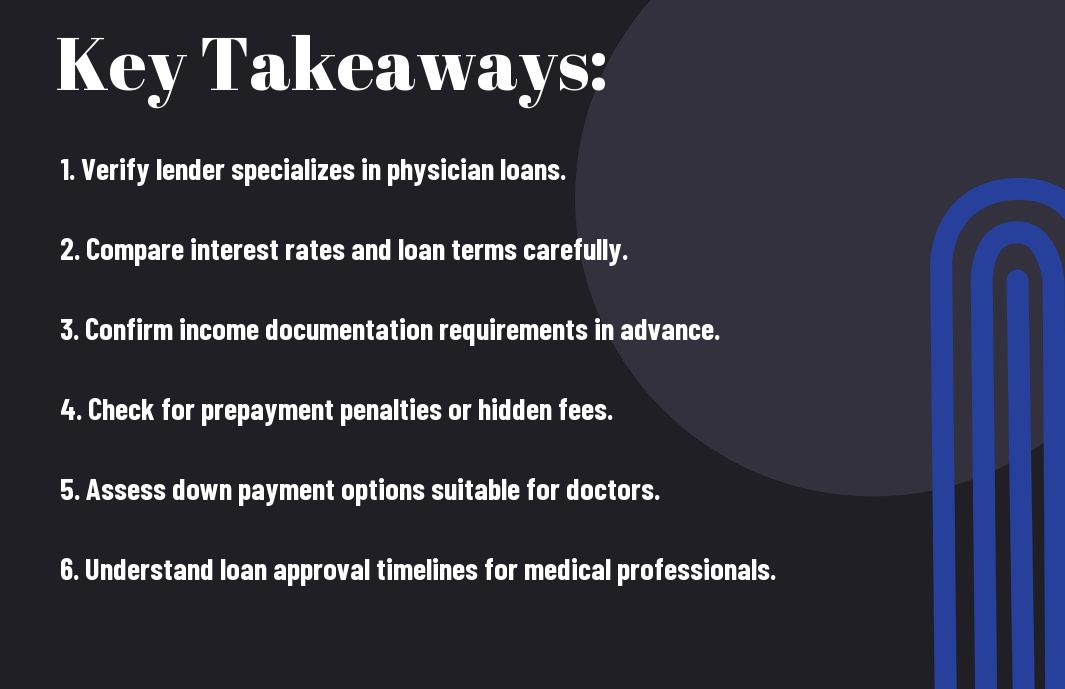

Tips for Securing the Best Terms

For physicians seeking the best terms on a doctor loan, it’s necessary to prepare thoroughly and be proactive. Here are some key tips to consider:

- Maintain a strong credit score.

- Gather all financial documents in advance.

- Shop around to compare loan offers.

- Consider working with a lender specializing in physician loans.

- Understand the various loan structures available to you.

Recognizing these factors will empower you in securing favorable loan terms that fit your financial needs.

Strengthening Your Application

For a successful loan application, present your financial history clearly and compellingly. Provide comprehensive documentation, including proof of income, student loan information, and a solid overview of your assets. Additionally, highlighting any specialized training or residency completion can enhance your credibility as a candidate. This demonstration of your financial responsibility and potential future earnings will bolster your application significantly.

Negotiating Rates and Terms

An effective way to enhance your loan package is by negotiating rates and terms with lenders. Don’t hesitate to ask for better rates, reduced fees, or more favorable repayment options. Strengthening your position may involve sharing your financial qualifications or exploring different lenders to find the best deal.

With the competitive landscape of doctor loans, lenders are often willing to negotiate—especially when you demonstrate your value as a borrower. Presenting your unique financial situation can help in discussions around interest rates and repayment terms. Leverage any offers you receive from other lenders, while emphasizing your purpose and the stability of your future income. This strategy can significantly enhance your negotiating position to secure the most advantageous terms for your loan.

Final Words

To wrap up, ensuring you meet the requirements for a doctor loan is vital for your financial journey as a physician. By following the vital checklist outlined, you can enhance your chances of obtaining favorable loan terms tailored for your unique profession. Be proactive in gathering necessary documentation, understanding your credit score, and exploring lender options. This preparation not only smooths your borrowing process but also empowers you to make informed financial decisions that align with your future goals.