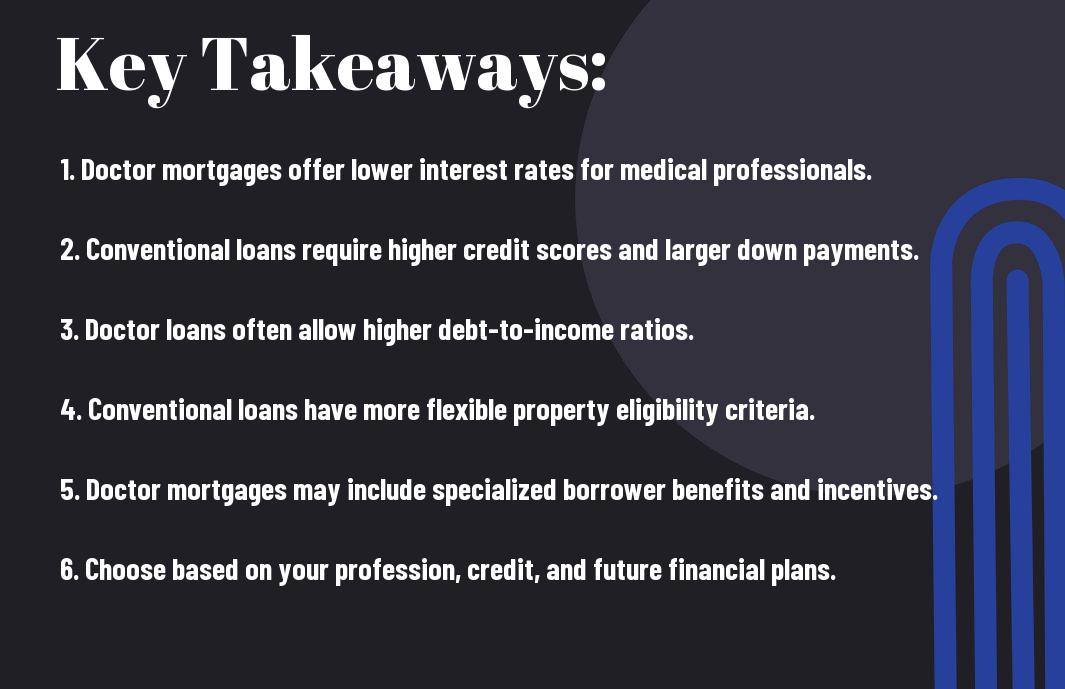

Just as you navigate the complexities of your medical career, choosing the right mortgage option is vital for your financial future. While conventional loans may seem like a straightforward choice, doctor mortgages offer unique advantages tailored for your situation as a healthcare professional. Understanding the differences between these two financing options can help you make an informed decision that aligns with your long-term goals. In this blog post, we’ll explore the benefits and drawbacks of each to aid you in selecting the mortgage that best suits your needs.

Understanding Doctor Mortgages

As a medical professional, you may find that doctor mortgages are tailored specifically to your unique financial situation. These loans cater to the challenges and opportunities presented during the transition from residency or fellowship to your professional career. With specialized terms and conditions, doctor mortgages can help you achieve homeownership more easily than conventional loans.

Definition and Key Features

Mortgages designed for doctors provide specific benefits that can greatly assist you in securing a home. Key features of doctor mortgages include:

- No or low down payment options

- Flexible debt-to-income ratio criteria

- Loan amounts that accommodate your future earnings potential

- Ability to qualify without established credit history

- Competitive interest rates

After understanding these features, you can better assess whether a doctor mortgage aligns with your financial goals.

Eligibility Criteria

Eligibility for doctor mortgages typically hinges on specific professional qualifications, ensuring that those in the medical field can benefit from these tailored loans.

As a physician, your eligibility may be determined by criteria such as the type of medical degree you hold, your current employment status, and sometimes even the type of residency or fellowship program you completed. Lenders often consider recent graduates from accredited medical programs as eligible, even if you have not yet secured a full-time position, recognizing your potential earning power. Understanding these criteria is vital when considering your financing options.

Conventional Loans Explained

Assuming you’re exploring financing options for your home, conventional loans provide a widely-used path. These loans are not backed by the government and typically fall into two categories: conforming and non-conforming loans. Understanding their definition and key features is vital in determining if they align with your financial goals.

Definition and Key Features

Across various financial landscapes, conventional loans are characterized by their straightforward terms and reliable structures. Key features include:

- Fixed or adjustable interest rates

- Loan amounts typically up to $548,250 for conforming loans

- Down payments ranging from 3% to 20%

- Monthly private mortgage insurance (PMI) for low down payments

This comprehensive understanding can help you decide if a conventional loan is the right fit.

Eligibility Criteria

Definition of eligibility criteria is vital in securing a conventional loan. Lenders usually consider your credit score, income stability, and debt-to-income ratio.

But qualifying for a conventional loan requires attention to more than just your credit score. You typically need a minimum credit score of 620, a steady income history, and a manageable level of debt. Lenders will assess your financial situation to ensure that you can comfortably handle monthly payments, so it’s wise to review your finances before applying.

Comparing Interest Rates

Now, understanding the differences in interest rates between doctor mortgages and conventional loans can help you make informed financial decisions. Here’s a comparison to consider:

| Loan Type | Typical Interest Rate Range |

|---|---|

| Doctor Mortgages | 3.0% – 4.5% |

| Conventional Loans | 3.5% – 5.0% |

Doctor Mortgages vs. Conventional Loans

Loans tailored for medical professionals often feature more favorable interest rates compared to conventional loans. As a newly minted physician, you can benefit from these specialized rates, which may help decrease your monthly payments and overall costs.

Long-Term Impact on Financial Future

Below, the long-term effects of choosing between doctor mortgages and conventional loans are significant. Opting for lower interest rates today can lead to substantial savings over the life of your loan, ultimately impacting your financial stability and ability to invest elsewhere.

With a doctor mortgage, the potential for lower rates can enhance your ability to save for retirement or make other investments. The savings accumulated from a lower interest rate can free up cash flow for your current needs, allowing you to focus on your career and personal goals, rather than worrying about high monthly payments. Selecting the right mortgage option is a step towards securing a stable and prosperous financial future.

Down Payment Requirements

For many aspiring homeowners, the down payment is a significant consideration when deciding between doctor mortgages and conventional loans. It’s vital to understand how the requirements differ for each option, as this will impact your immediate financial commitment and long-term investment strategy.

Doctor Mortgages

Before exploring doctor mortgages, you should know that they often come with more flexible down payment options. Many lenders allow qualified physicians to secure a home with little to no down payment, making homeownership more accessible right out of residency or medical school.

Conventional Loans

Before opting for conventional loans, it’s important to consider their standard down payment requirements. Typically, these loans require a minimum of 3% to 5% down, though a 20% down payment is preferred to avoid private mortgage insurance (PMI).

In fact, higher down payments can lower your monthly mortgage payments and reduce interest costs over the loan term. However, if you’re unable to save that much upfront, you may have to factor in additional monthly costs associated with PMI, which can significantly affect your budget. Understanding these nuances will help you make a more informed decision about your financial future.

Loan Limits and Amounts

After understanding the importance of loan types, it’s vital to explore their respective limits and amounts. Doctor mortgages typically offer higher loan amounts with more flexible underwriting guidelines, making them suitable for medical professionals like you. In contrast, conventional loans come with specific loan limits that may not accommodate high-value purchases, particularly in competitive real estate markets.

Maximum Financing for Doctor Mortgages

Any doctor mortgage gives you the opportunity to borrow up to 100% of the home’s value, often allowing for higher loan amounts without the weight of private mortgage insurance (PMI). This can significantly aid you in your home purchasing journey, enabling you to secure a property that aligns with your lifestyle and financial goals.

Conventional Loan Limitations

Amounts for conventional loans typically fall under established limits based on government guidelines. These limits can vary depending on your location and the specifics of the property, making it challenging for you to access the funds needed for your ideal home. If the home price exceeds these limits, you may face restrictions and additional costs, such as a larger down payment or higher interest rates.

This limitation can be particularly constraining in high-cost areas, where the average home prices often surpass conventional loan thresholds. As a result, you may find yourself needing to save for a larger down payment or seek alternative financing options to meet your homeownership desires. Understanding these constraints allows you to better plan your financial future and evaluate your best options.

Pros and Cons of Each Option

Your choice between doctor mortgages and conventional loans will depend on your unique financial situation. Each option has its advantages and disadvantages that are vital to consider.

| Doctor Mortgages | Conventional Loans |

|---|---|

| Lower down payment options | More flexible terms |

| No private mortgage insurance (PMI) | Available to a wider audience |

| Tailored for those with student debt | Generally lower interest rates |

| Higher loan limits | Potential for quicker approvals |

| Understanding of doctor’s financial trajectory | Access to various loan types |

Advantages of Doctor Mortgages

At the forefront, doctor mortgages cater specifically to medical professionals, offering benefits such as lower down payments and no PMI. This makes it easier for you to secure financing, especially if you’re managing student loan debt. Their unique structure can help you achieve homeownership sooner, allowing you to focus on your career and financial goals without the burden of a large upfront payment.

Drawbacks of Conventional Loans

Option for conventional loans may seem appealing, but they come with certain limitations that could impact your financial strategy.

The main drawbacks include the need for a larger down payment, which can be a barrier for many first-time buyers, especially if you have significant student loans. Additionally, conventional loans often require private mortgage insurance (PMI) if your down payment is below 20%, adding to your monthly costs. Their eligibility criteria can also be stricter, making it challenging for you if you’re just starting your career and haven’t established a long credit history.

Final Words

On the whole, choosing between doctor mortgages and conventional loans depends on your unique financial situation and long-term goals. If you’re a medical professional seeking specialized benefits, a doctor mortgage may offer advantages like lower down payments and no private mortgage insurance. However, if your financial profile aligns better with conventional loans, they might offer greater flexibility in terms of property types and overall loan terms. Ultimately, carefully assess your needs, evaluate each option’s pros and cons, and consult a financial advisor to align your choice with your aspirations for financial success.