Most physicians find themselves in unique financial situations upon completing their training, making home loan programs specifically designed for doctors an attractive option. These programs offer distinct advantages, such as low down payments and more flexible qualification criteria. However, they also come with potential drawbacks that could impact your financial future. In this post, you will explore the benefits and pitfalls of physician home loan programs, helping you determine if it’s the right choice for your home buying journey.

The Allure of Physician Home Loans: A Closer Look

Physician home loans have become increasingly popular among medical professionals, offering tailored benefits that cater to your unique financial standing. These specialized mortgage options streamline the home-buying process, alleviating some burdens that come with hefty student debt and fluctuating income during residency. Understanding the specific advantages and components of these loans can help you decide if this approach aligns with your financial goals and lifestyle.

Unique Financial Advantages for Medical Professionals

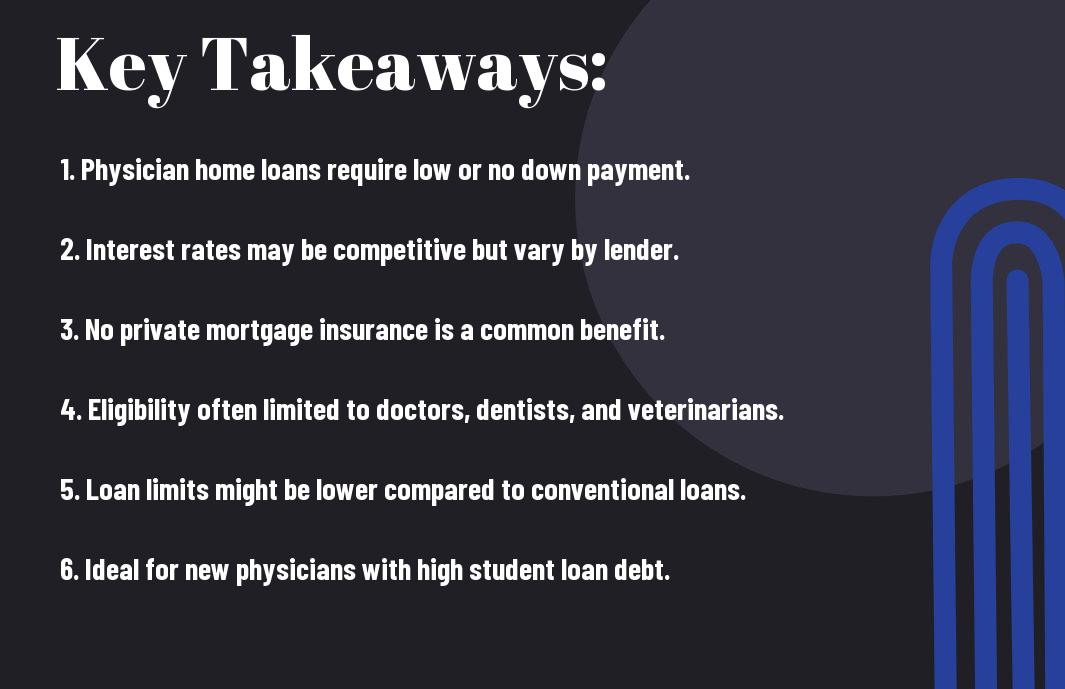

Your financial landscape as a physician is distinct, with high earning potential often counterbalanced by significant student debt. Physician home loans typically allow you to qualify for a mortgage with little to no down payment, reducing the upfront costs of homeownership. Additionally, they often permit you to bypass private mortgage insurance (PMI), saving you hundreds of dollars monthly.

Competitive Interest Rates and Forgiveness Options

The competitive interest rates associated with physician home loans can be a game-changer for your financial strategy. Many lenders recognize your potential as a high-income earner in the coming years, often securing rates lower than those available to typical borrowers. Moreover, certain programs may offer loan forgiveness options for your mortgage balance if you commit to working in underserved areas or specific medical facilities, ultimately easing your repayment burdens.

For example, many physician home loan programs provide special considerations regarding credit scores and debt-to-income ratios, acknowledging that your financial journey may be different from others. Some lenders even allow for adjusted debt calculations that exclude student loan payments. This can result in a significantly lower interest rate, effectively saving thousands over the life of the loan. Understanding these competitive elements positions you to make the most of your financial opportunities in homeownership.

Navigating the Downsides: The Risks of Physician Home Loans

While physician home loan programs offer numerous advantages, it’s imperative to consider the potential drawbacks. These loans can come with hidden costs and uncertainty that may affect your financial stability. Awareness of these risks allows you to make an informed decision about whether this financing option aligns with your long-term goals.

Potential Hidden Fees and Long-term Costs

Mortgage lenders may charge fees that aren’t immediately apparent, such as origination or processing fees. Additionally, some programs may come with higher interest rates in the long run, significantly increasing the total cost of your mortgage. Always scrutinize the loan disclosure documents and ask your lender about all possible fees before committing.

The Impact of Market Fluctuations on Loan Viability

Market conditions can greatly influence the value of your home and, consequently, your home loan’s effectiveness. If the housing market experiences a downturn, you could find yourself owing more than your property is worth, impacting your ability to refinance or sell later.

For instance, if you purchase a home at peak prices only to see a 10-15% drop in value during an economic downturn, the equity you initially anticipated could evaporate quickly. This scenario not only affects your financial position if you aim to relocate or downsize but could also hinder your ability to take on additional debt in the future. The volatility of the real estate market means that timing and economic conditions play significant roles in the success of your home purchase through a physician loan program. Understanding these dynamics will enable you to strategize better for potential risks associated with your journey into home ownership.

Tailoring Your Financial Strategy: Aligning Goals with Loan Options

Choosing the right loan requires a clear understanding of how it aligns with your long-term financial goals. A home loan designed for physicians may offer favorable terms, but it might not be suitable for everyone. By evaluating your career trajectory, expected income growth, and personal aspirations, you can select a loan that complements your unique circumstances and helps you achieve homeownership without compromising your financial wellbeing.

Assessing Your Financial Situation and Lifestyle Needs

Your current financial situation significantly influences which loan option best suits your needs. Take stock of your income, savings, debt levels, and projected expenses. Consider your lifestyle preferences as well, such as proximity to work and quality of local schools. By assessing these elements, you can make informed decisions that align your financial commitments with your lifestyle aspirations.

The Importance of Shop Around for Competitive Rates

Finding the right mortgage rate can make a substantial difference in your overall payment structure. Even a small change in interest rates can result in significant savings over the life of your loan. Therefore, exploring multiple lenders and comparing their offers can uncover more favorable terms, which can save you money in both the short and long term.

Shopping around not only helps you identify competitive rates but also gives you leverage in negotiations. Different lenders may provide far-ranging rates, closing costs, or loan features tailored to physicians, so investing time in research could yield better results. For example, one lender might offer a lower interest rate while another might provide better loan terms, such as no PMI (private mortgage insurance) or more generous debt-to-income ratios. Evaluating these options can help optimize your mortgage and ensure it aligns with your financial strategy.

Expert Insights: What Financial Advisors Say About Home Loan Programs

Financial advisors recognize the potential benefits of physician home loan programs, often highlighting their unique features tailored specifically for medical professionals. Many note that these loans can ease the path to homeownership, allowing you to leverage your income trajectory despite existing student debt. Advisors commonly emphasize the importance of understanding both your current financial situation and future earnings to fully benefit from these offerings.

Perspectives on Debt-to-Income Ratios and Loan Affordability

The debt-to-income (DTI) ratio plays an vital role in determining your eligibility for a home loan. Financial advisors suggest that many lenders using physician home loan programs may be more lenient on DTI ratios, which can particularly benefit you if you have substantial student loans. This flexibility allows you to qualify for a larger loan than traditional programs typically permit, making it easier to secure your dream home.

The Balancing Act: Ensuring Long-term Financial Stability

Achieving long-term financial stability while taking advantage of physician home loan programs involves careful planning and financial discipline. While these loans can provide immediate access to property ownership, they may lead to higher monthly payments relative to your income. Ensuring that you have adequately budgeted for other expenses—such as retirement savings, family obligations, and emergency funds—is crucial to maintaining your overall financial health.

Consider your overall financial goals when opting for a physician home loan. It might be tempting to utilize a large portion of your income for mortgage payments, especially with favorable loan terms. However, prioritizing savings for retirement and emergency funds can help you avoid potential financial strain in the future. Creating a comprehensive budget that balances mortgage expenses with savings and other life goals will safeguard your long-term financial stability. Engaging with a financial advisor can also provide personalized strategies to ensure you remain on track even as your financial landscape evolves.

Real-World Implications: Success Stories and Cautionary Tales

Profiles of Physicians Who Benefited from Home Loan Programs

Numerous physicians have found success with home loan programs, transforming their financial futures. For instance, Dr. Smith, an orthopedic surgeon, purchased his first home in a competitive market without the burden of a hefty down payment. Utilizing a physician loan allowed him to allocate funds toward renovations, enhancing both his living space and equity over time. Similarly, Dr. Lee, a new graduate, leveraged a physician home loan to establish roots in a vibrant community, ultimately enhancing his personal and professional life.

Lessons Learned: Avoiding Common Pitfalls

While many physicians thrive through these home loan programs, pitfalls exist that you should avoid. A common issue arises from not thoroughly understanding the loan terms, leading to unexpected fees or higher interest rates. Some physicians also underestimate the importance of a robust budgeting plan after acquiring a home, which can strain finances if not managed correctly.

Diving deeper into the lessons from peers, misalignment of purchase price and personal financial capability stands out as a frequent error. Many doctors overestimate their income potential, resulting in homes that strain their budgets. Setting realistic expectations regarding costs associated with homeownership, from maintenance to insurance, proves vital. Consulting with a financial advisor to create a comprehensive budget post-purchase can help prevent regretful decisions that might overshadow the initial excitement of homeownership.

Conclusion

Hence, evaluating the pros and cons of physician home loan programs is imperative for determining if it aligns with your financial goals and needs. These specialized loans can offer significant advantages, such as lower down payments and reduced mortgage insurance, which could be beneficial for your situation. However, the potential drawbacks, including higher interest rates and limited lender options, are factors to consider. Ultimately, weighing these elements will guide you in making an informed decision that best serves your financial future as a physician.