Loans designed specifically for physicians can be a game changer as you launch on your medical career. Navigating the intricacies of physician loan programs can seem daunting, but understanding these options is vital for your financial success. In this comprehensive guide, you will discover how these unique loans cater to your needs, the benefits they offer, and the criteria you must meet to secure one. Armed with the right information, you can make informed decisions that will support your journey from residency to homeownership.

Demystifying Physician Loan Programs

Professional loans tailored for physicians can often appear complex, but understanding their core elements allows you to make informed decisions about home financing. Unlike standard loans, physician loan programs cater specifically to medical professionals, leveraging your unique status to provide more advantageous terms. Features such as zero or low down payment options, no private mortgage insurance (PMI), and flexible underwriting criteria related to student debt create a landscape that is generally absent in traditional lending practices.

Defining Physician Loans: What Sets Them Apart

Physician loans stand apart by offering specialized terms designed for new doctors. These loans take into account your future earning potential rather than just your current financial situation. This means aspects like high student debt or a lack of significant savings due to prolonged education are less likely to impede your home-buying aspirations. Often, these loans also feature competitive interest rates, maximizing affordability at a crucial point in your career.

The Unique Financial Landscape for New Doctors

The financial landscape for new doctors is filled with complexities, primarily due to the burden of medical school debt, which averages around $200,000 for graduates. While this significant debt might deter traditional lenders, physician loan programs recognize your potential as a high-earning professional. With starting salaries for residents often ranging between $50,000 to $60,000, securing housing can feel daunting. However, these programs alleviate barriers, enabling you to focus on your practice rather than the intricacies of financing a home. By leveraging your future earning power, you can navigate home ownership with greater ease, allowing for stability as you transition into your medical career.

The Financial Metrics that Matter

Financial metrics play a pivotal role in establishing your eligibility for physician loan programs. Lenders assess various key indicators, such as your debt-to-income ratio, credit score, and overall financial history, to determine how much they can lend and under what terms. Understanding these metrics will provide you with the confidence to navigate the loan application process more effectively and secure favorable mortgage options tailored to your situation as a new doctor.

Understanding Debt-to-Income Ratios

A debt-to-income (DTI) ratio is calculated by dividing your total monthly debt payments by your gross monthly income. This percentage helps lenders evaluate your ability to manage monthly payments and repay borrowed money. For physician loan programs, a DTI of 40% or less is typically viewed favorably, as lenders appreciate the reduced risk associated with your earnings potential.

How Credit Scores Affect Your Loan Eligibility

Your credit score significantly impacts your loan eligibility, influencing the interest rates offered and the terms of the mortgage. A higher credit score often correlates with lower interest rates and better loan terms since it demonstrates your reliability in managing debt. Generally, a score of 700 or above is considered good for most lenders. However, some physician loan programs offer flexibility, accepting scores as low as 620, recognizing the unique financial challenges faced by new doctors.

Maintaining a strong credit score involves timely bill payments, minimizing credit card balances, and managing existing debt responsibly. Small fluctuations in your credit score can lead to noticeable changes in loan offers; for instance, a jump from a 680 to a 700 score could save you thousands in interest over the life of your mortgage. As you transition into your medical career, prioritize building and maintaining your credit health to enhance your financial stability and access to better loan options.

Navigating the Application Process

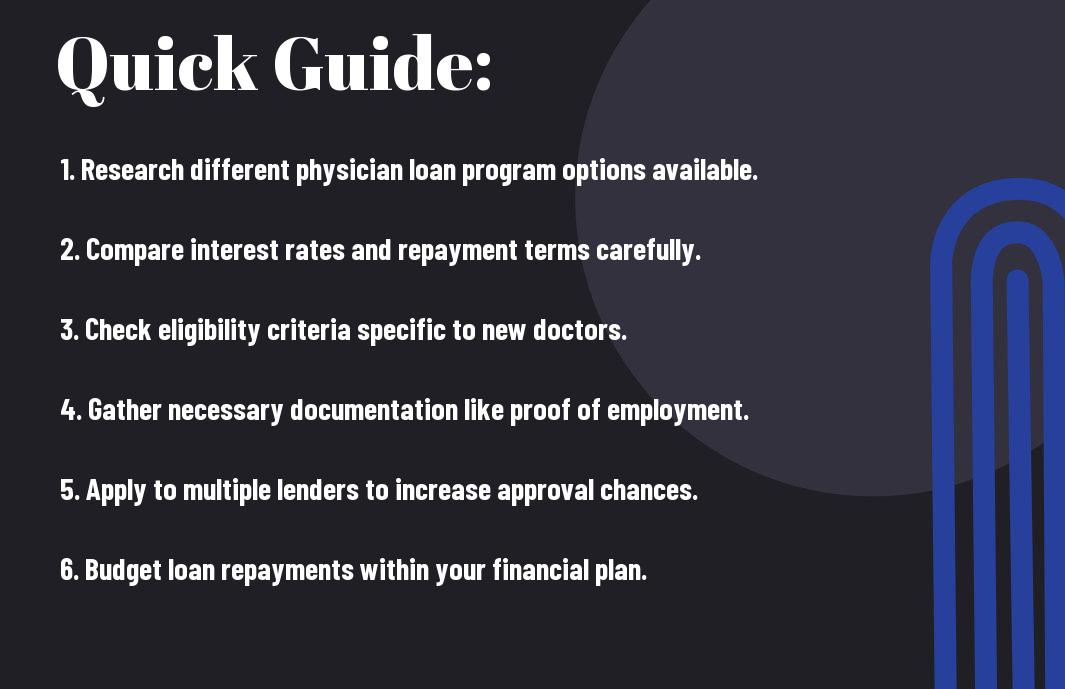

Executing the application process for a physician loan requires attention to detail and thorough preparation. Each lender may have different requirements, but you can find common ground across the board. To streamline your journey, prioritize gathering necessary documentation and understanding each stage of the application. This will not only speed things up but also help you avoid unnecessary delays.

Step-by-Step Guide to Applying for a Physician Loan

| Step | Description |

|---|---|

| 1. Research Lenders | Explore various lenders that offer physician loans and compare terms. |

| 2. Gather Documentation | Collect your income statements, proof of residency, and any other required documents. |

| 3. Complete the Application | Fill out your application accurately, ensuring all sections are complete. |

| 4. Review Terms | Before accepting, thoroughly read and understand the terms of the loan. |

| 5. Close the Loan | Finalize the process by signing the necessary documents and receiving funding. |

Common Pitfalls to Avoid During Application

Avoiding common pitfalls can significantly enhance your chances of a successful application. Incomplete applications, unclear income sources, or refusing to shop around can lead to missed opportunities or higher rates. Staying organized and informed can minimize oversights that may derail your efforts.

Incomplete documentation often results in delays and rejection, so ensure all paperwork is in order prior to submission. Be mindful of your credit score—small discrepancies can hinder progress if not rectified early. Additionally, some applicants mistakenly limit their search to familiar banks; exploring multiple lenders expands your options and secures better rates. By proactively addressing these common issues, you fortify your application and enhance the likelihood of approval.

Maximizing Your Loan Benefits

To fully leverage your physician loan program, understanding the specialized features it offers can transform your financial landscape. Employing tools like deferred repayment options and competitive interest rates can enhance your budget. By aligning your loan structure with your unique financial circumstances, you can achieve both short-term relief and long-term financial stability. Considering refinancing options or even exploring loan forgiveness programs can also further intensify your benefits, ultimately providing you with an advantageous start in your medical career.

Strategies for Getting the Best Rates

Securing the best rates on your physician loan begins with thorough research and preparation. Gathering financial documents, understanding your credit score, and comparing multiple lenders play vital roles in this process. Additionally, joining professional organizations or networks often unveils exclusive rates tailored for medical professionals, offering you a competitive edge in negotiating favorable terms.

Leveraging Loan Features for Financial Flexibility

Taking full advantage of loan features can lead to greater financial flexibility. Options such as interest-only payments during residency can lower your initial financial burden, while no private mortgage insurance (PMI) requirements can save you significant costs. Furthermore, consider loans that allow for prepayment without penalties, enabling you to pay down the principal quicker when your financial situation improves, thus decreasing the overall interest incurred.

For instance, if you select a loan that permits interest-only payments for the first five years, you maintain lower monthly expenses while establishing your practice. This flexibility not only accommodates your evolving financial situation but also supports your lifestyle and personal commitments as you transition from training to full-time practice. Being strategic about which features align with your career path enables you to cultivate a healthy financial foundation from the outset.

Perspectives from Financial Advisors and Peers

Financial advisors and fellow physicians provide insights that can shape your approach to physician loans. Advisors highlight the importance of tailoring loan options to your unique financial situation while peers share valuable experiences about navigating the home buying process. Accessing these perspectives can give you the confidence to make informed decisions that align with your career and lifestyle goals.

Insights from Financial Experts on Loan Strategies

Financial experts emphasize the necessity of assessing your long-term financial plan when considering a physician loan. Strategies may include comparing interest rates across various lenders and understanding the implications of variable vs. fixed rates. They often recommend leveraging loan benefits, like no private mortgage insurance (PMI) requirements, to maximize affordability and minimize upfront costs.

Real Stories and Lessons from Fellow Physicians

Learning from fellow physicians’ experiences can provide invaluable context as you navigate your financial journey. Many share stories of their own struggles and successes, such as securing favorable loan terms that allowed them to invest in both their homes and careers. These narratives often highlight the importance of conducting thorough research and connecting with professionals who specialize in physician loans.

Hearing real-world stories from physicians can illuminate the variety of paths you might take. For instance, one doctor recounts how carefully comparing different programs led to a significant reduction in monthly payments. Another experienced buyer speaks about the benefits of working with a realtor familiar with physician loans, ultimately making the process more efficient and less stressful. These insights not only reveal potential pitfalls but also underscore helpful strategies that can save you time and money as you launch on your journey to home ownership.

To wrap up

Ultimately, understanding physician loan programs is crucial for your financial journey as a new doctor. With tailored lending options designed to support your unique situation, you can secure the home financing you need without the added stress of high debt-to-income ratios. By familiarizing yourself with these programs, you can make informed decisions that align with your long-term financial goals, paving the way for a successful transition into your medical career. Embrace this knowledge to empower your home-buying experience and set yourself up for success.