Buying your first home as a physician can be both exciting and challenging, especially with the unique financial circumstances you may face. Understanding how to leverage physician mortgage programs can significantly ease the process and help you secure favorable loan terms. In this guide, you’ll discover important tips to navigate these specialized mortgage options, making the most of your earnings and investment potential. Let’s look into how you can effectively tackle home buying tailored specifically for medical professionals like you.

The Unique Financial Landscape for Physicians

Physicians navigate a financial landscape markedly different from other professions. With the hefty student debt often carried into practice, high-income potential, and specific loan structures tailored to your career, it’s vital to understand how these elements interplay to influence your home buying journey. Most physician mortgage programs take into account your earning trajectory and the unique cash flow patterns of medical training, allowing you to leverage your income potential right from the start.

Understanding Physician Income Dynamics

Your income as a physician tends to be front-loaded compared to other professions, often characterized by considerable salary jumps post-residency. Initially, wages may seem constrained during your training period. However, once you secure a position, potential earnings can range widely – sometimes exceeding $300,000 annually – which can significantly impact your mortgage eligibility and purchasing power.

Navigating Student Loan Obligations

Student loan obligations play a significant role in your overall financial picture. Many lenders factor in these debts when assessing your mortgage application, but specialized physician mortgage programs may allow room for leniency. They often overlook certain types of student debt in your debt-to-income ratio, enabling you to qualify for larger homes than traditional loan programs would allow.

With an average of over $200,000 in student loan debt upon finishing medical school, you might feel hesitant about your financial standing. However, many lenders offering physician mortgage programs recognize the long-term earning potential associated with your profession. They may even offer competitive rates or down payment structures that reduce your upfront costs, allowing you to enter homeownership without feeling financially stifled by your student loans. By exploring these tailored options, you can position yourself for advantageous financial decisions early in your career, benefiting from your unique earnings trajectory while planning for long-term financial stability.

Unpacking Physician Mortgage Programs

Physician mortgage programs are specially designed to address the unique financial challenges that doctors face. These loans often provide favorable terms that allow you to purchase a home without the typical limitations found in conventional mortgages. Understanding these features can empower you to make informed decisions in your home-buying journey.

Key Features and Benefits

These mortgage programs come with several unique advantages aimed at easing your path to homeownership.

- No private mortgage insurance (PMI) even with a low down payment.

- Down payments as low as 0% to 10%, depending on the lender.

- Flexibility with student loan debt considered in a unique manner.

- Potential access to higher loan limits tailored for medical professionals.

- Specialized underwriting processes that can simplify approval.

This combination of features can facilitate homeownership for you, even if you are early in your career or facing high levels of educational debt.

Common Misconceptions Explored

While physician mortgage programs can be beneficial, several misconceptions might cause hesitation. Some believe these loans are only for recent graduates, while others worry that they come with hidden fees or increased interest rates. In reality, lenders recognize physicians’ financial potential, and these programs are accessible at various stages of your career. Many lenders aim to support you in achieving homeownership, offering competitive interest rates and clear terms without the common pitfalls associated with conventional loans.

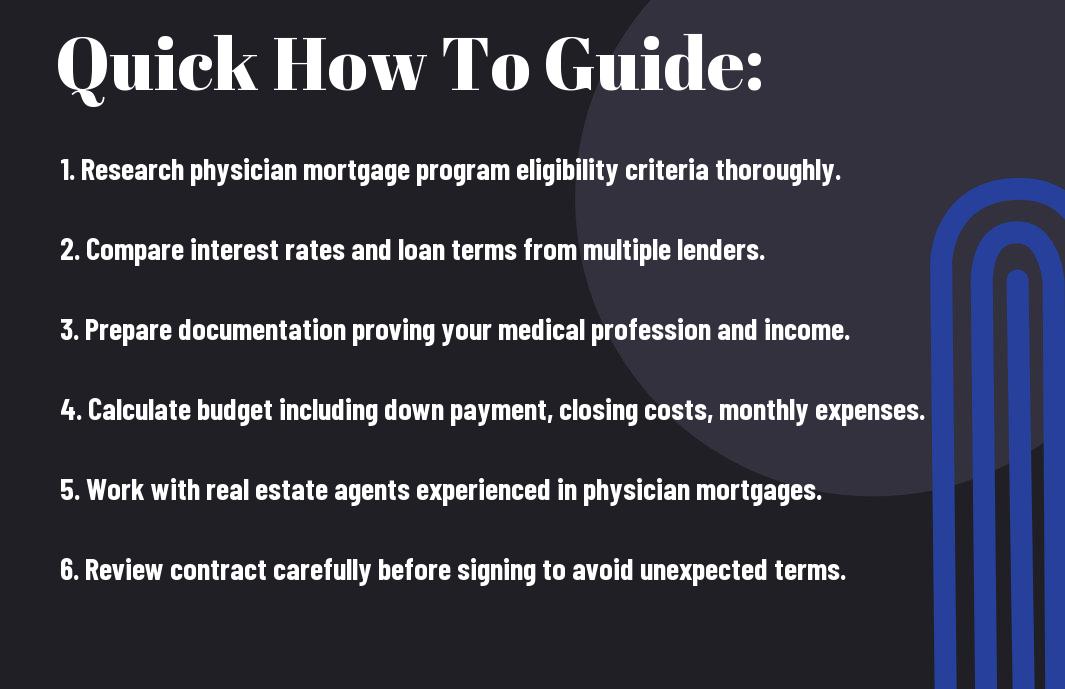

Strategic Home Buying Tips for Doctors

Navigating the real estate market can be daunting for physicians, but implementing strategic approaches can lead to better outcomes. Prioritize your needs, leverage your unique financial position, and stay informed about local market trends. Here are key strategies to consider:

- Research neighborhoods that align with your lifestyle and professional needs.

- Utilize your physician mortgage program to secure favorable financing terms.

- Engage a real estate agent familiar with working with doctors.

- Evaluate potential homes for both present and future income stability.

Perceiving the home-buying process as a long-term investment rather than a mere transaction can save you time and money down the line.

Timing the Market: When to Buy

Identifying the right moment to buy is crucial. Keep an eye on market cycles and interest rates, as buying during a downturn can yield significant savings. Analyzing the seasonal trends—such as purchasing in the spring or early summer—can offer an edge with more inventory available. Ultimately, timing should align with your personal readiness and financial stability.

Assessing Long-Term Value in Property Purchase

Choosing a home with an eye on its long-term value can enhance your financial position. Look beyond aesthetic appeal; consider the upward potential of neighborhoods and resale value implications. Factors such as school district quality, access to healthcare facilities, and community amenities can all influence property appreciation over time.

To effectively assess long-term value, research market trends and historical data of neighborhood appreciation rates. Properties in desirable locations typically see maintained or increased value, which can serve as a safety net should you sell in the future. Moreover, consider properties that allow for potential renovations or expansions, as these improvements can significantly boost market value. Evaluating local economic indicators—job growth, median income levels, and upcoming infrastructure projects—can provide insights into the potential for sustainable appreciation in the property’s value.

The Art of Negotiation in Real Estate

Mastering negotiation is key to securing a favorable deal in real estate. Your ability to navigate the discussions with sellers, listing agents, and even mortgage lenders can significantly impact the financial terms of your home purchase. Knowing when to push for concessions and how to balance assertiveness with flexibility can facilitate a smoother transaction, allowing you to focus on transitioning into your new home rather than the complexities of the buying process.

Leveraging Your Status as a Physician

Your profession as a physician can often enhance your negotiating power. Many sellers view doctors as reliable, financially stable buyers, making them more inclined to negotiate favorably with you. Utilize this perception to build rapport and gain trust during negotiations, which can often lead to better purchase terms or lower prices when making an offer.

Effective Communication Tactics

Clear and confident communication can transform your negotiations. Adapting your tone and body language to convey professionalism reinforces your position as a serious buyer. Approach discussions with facts about market trends, comparable sales in the area, and a clear understanding of your priorities. The ability to articulate your needs while actively listening to the seller’s perspective can uncover opportunities for beneficial compromises.

Articulating your viewpoint effectively fosters a collaborative environment. Begin by establishing common ground to engage the seller in a dialogue about their motivations and needs. This can often reveal valuable insights into their willingness to negotiate. Always back your proposals with data—citing recent sales or market conditions lends credibility to your stance and reduces the chances of being dismissed. Culture of respect in communication reinforces your professionalism, which may sway sellers to consider your offers more favorably, leading to a successful negotiation process.

Essential Pitfalls to Avoid

Being aware of potential pitfalls can save you from significant financial setbacks when entering the housing market. It’s easy to overlook small details amidst the excitement of home buying, but small miscalculations can lead to major consequences. Here are two critical areas you should navigate with care.

Financial Miscalculations

Many physicians underestimate costs associated with homeownership, leading to unexpected financial strain. From property taxes and maintenance expenses to home insurance and homeowner association fees, these recurring costs can add up quickly. You should create a comprehensive calculation that encompasses not just your mortgage payment but all related costs to avoid unpleasant surprises.

Overextending Your Budget

Stretching your budget can lead to stress and financial instability. Physicians often feel pressure to buy larger homes or those in upscale neighborhoods, influenced by their income and lifestyle expectations. However, avoiding the temptation to spend beyond your means helps maintain a comfortable financial cushion, ensuring you can continue to focus on your medical career without the burden of financial strain.

Establishing a clear budget is vital before beginning your home search. Consider both your current income and your potential future earnings as a physician, but also factor in loan payments, maintenance, and other living expenses. It’s wise to set a maximum price for your home that considers the long-term impact on your financial health, rather than merely stretching to fit a monthly mortgage payment. This approach will allow you to enjoy your new home without continual financial anxiety.

Final Words

Ultimately, navigating the home buying process as a physician can be greatly simplified by leveraging physician mortgage programs. By understanding the unique benefits these programs offer, such as low down payments and lenient debt-to-income ratios, you can maximize your financial advantages. Take the time to compare different lending options, assess your personal financial situation, and work with a knowledgeable real estate agent familiar with your needs. This strategic approach will help you secure the ideal home while ensuring your financial stability as you continue your important work in the medical field.