There’s a unique set of challenges that come with buying a home as a doctor, from your demanding schedule to financial considerations. This guide will walk you through the home buying process, breaking it down into manageable steps tailored specifically for you. With expert insights and practical tips, you’ll gain the knowledge needed to make informed decisions and navigate the complexities of securing your dream home confidently. Let’s get started on this important journey together.

Understanding Home Buying

For many doctors, the home buying process can be complex and overwhelming. It is important to familiarize yourself with the various components involved, including the types of properties you can choose from and the mortgages available to finance your purchase. By understanding these elements, you can make informed decisions that best suit your unique circumstances and financial goals.

Types of Properties

There’s a wide range of properties available on the market, each with unique characteristics and benefits. Understanding these options can help you select the right home for your needs.

| Single-family homes | Standalone residences ideal for families. |

| Condos | Units in a shared building, often with amenities. |

| Townhouses | Connected homes with no shared entries. |

| Multi-family homes | Properties designed to house multiple families. |

| Vacant land | Plots available for future construction. |

The right property type will depend on your lifestyle, budget, and long-term plans.

Types of Mortgages

Properties often involve various financing options, which is where understanding mortgages comes into play. The different types of mortgages available can significantly impact your monthly payments and overall financial stability.

| Fixed-rate mortgage | Stable monthly payments over the loan term. |

| Adjustable-rate mortgage | Variable interest rates that change over time. |

| FHA loans | Government-backed loans for low-to-moderate income buyers. |

| VA loans | Loans for veterans with low or no down payment. |

| Jumbo loans | Loans exceeding conforming loan limits, for luxury properties. |

This variety allows you to find the best mortgage type that aligns with your financial situation.

More on Types of Mortgages

Types of mortgages can significantly influence your buying experience. Consider factors such as your credit score, how long you plan to stay in the home, and market conditions. Each type has distinct pros and cons, so it’s vital to assess what aligns with your long-term financial objectives.

| Conventional loans | Standard loans not insured by the government. |

| Interest-only mortgage | Payments cover only interest for a set period. |

| USDA loans | Loans for rural property purchases with no down payment. |

| Energy-efficient mortgages | Loans that finance energy-saving improvements. |

| Balloon mortgage | A large payment due at the end of the loan term. |

This knowledge equips you to choose a mortgage that fits your financial strategy effectively.

The Home Buying Process

There’s a distinct journey involved in the home buying process, especially for medical professionals who must balance long hours with a desire to invest in real estate. This guide will help you move through the steps with clarity and ease, ensuring you make informed decisions as you navigate through the complexities of purchasing your new home.

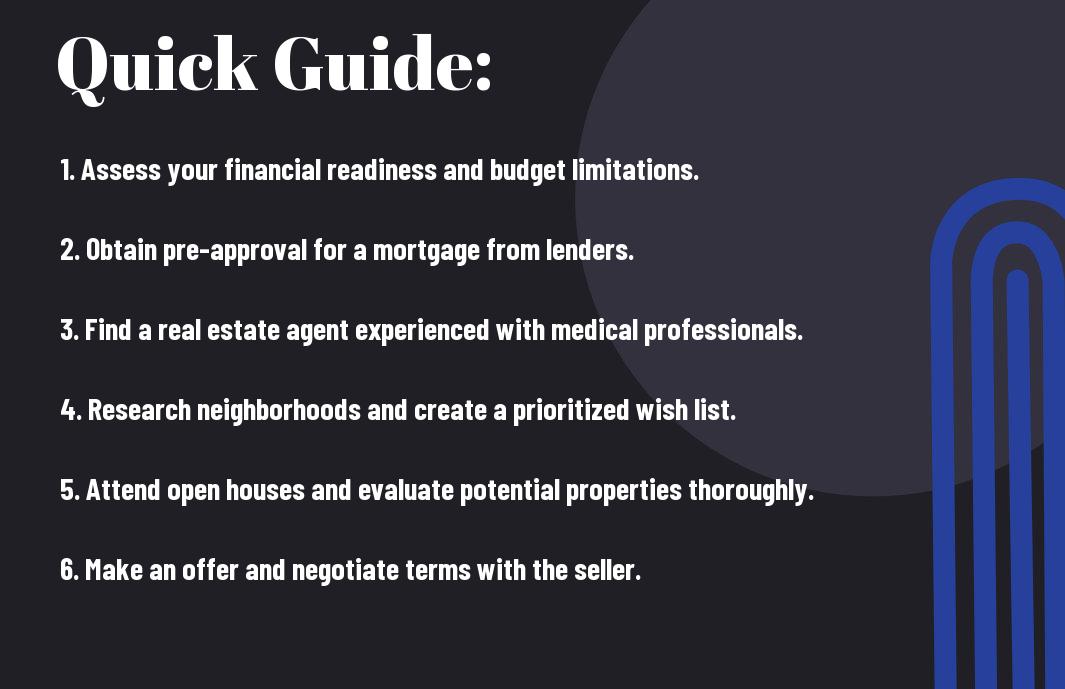

Step-by-Step Guide

Little by little, breaking the process into manageable steps can create a smoother experience. Below is a simplified overview of what to expect.

| Step | Description |

| 1. Assess Your Financial Health | Evaluate your savings, debts, and budget for home ownership. |

| 2. Get Pre-Approved | Meet with lenders to determine how much you can borrow. |

| 3. Hire a Real Estate Agent | Find an experienced professional to guide you through the process. |

| 4. Search for Homes | Visit potential properties that meet your needs. |

| 5. Make an Offer | Submit a competitive offer for your chosen home. |

| 6. Home Inspections | Have the home inspected for any potential issues. |

| 7. Close the Sale | Complete paperwork and finalize the transaction. |

Essential Documentation

For a seamless home buying experience, you’ll need to gather several key documents. These include financial records, tax returns, and proof of income, as they are necessary for the mortgage application and overall purchasing process.

Plus, be prepared to provide documentation such as bank statements, identification, and any other paperwork that might be requested by your lender. Having these items organized and readily available will not only streamline your mortgage application but also make your negotiating position stronger when making an offer on your desired property.

Factors to Consider

Not all homes are created equal, especially for doctors juggling a busy lifestyle. When navigating the home buying process, consider the following factors:

- Your personal lifestyle and family needs

- Future job stability and potential relocation

- Market trends and property value potential

- Accessibility to hospitals, clinics, and necessary amenities

Recognizing these aspects can significantly impact your overall satisfaction and investment in a home.

Location and Neighborhood

There’s more to a house than its walls; the right location significantly influences your quality of life. Consider the proximity to your workplace, schools, and community resources. Also, evaluate the neighborhood characteristics, such as safety, recreational opportunities, and social engagements, which will enhance your living experience.

Budget and Financing

For your home buying journey to be successful, establishing a realistic budget is imperative. This involves considering not just the purchase price, but also the recurring costs like property taxes, maintenance, and insurance.

For instance, when calculating your budget, assess your salary trajectory, student loan repayments, and other financial obligations. You might also explore options like FHA loans or physician home loans that cater specifically to medical professionals. Understanding your financing options and the total cost will empower you to make informed decisions without compromising your financial health.

Tips for Doctors

Many doctors face unique challenges in the home buying process. To ensure a smoother experience, consider these tips:

- Connect with a real estate agent who understands healthcare professionals.

- Get pre-approved for a mortgage to strengthen your buying position.

- Factor in your job’s location and schedule when choosing a home.

- Utilize available resources and programs tailored for medical professionals.

Recognizing these strategies will aid you in making informed decisions throughout your home buying journey.

Time Management Strategies

Some effective time management strategies for busy doctors include prioritizing tasks, setting a clear timeline for each phase of the home buying process, and using digital tools for organization. By maintaining a structured approach, you can balance your professional obligations with the demands of purchasing a home.

Navigating Healthcare-Specific Needs

Navigating the home buying process as a doctor requires consideration of specific needs related to your profession. You may want to be close to hospitals or clinics, which can influence your decision on where to buy. Additionally, recognizing the importance of a home office or a quiet space for study and work-related tasks will be vital during your search.

It is necessary to evaluate how your professional lifestyle impacts your housing needs. For instance, proximity to medical facilities can enhance your work-life balance, while adequate space for a home office is important for managing your medical responsibilities. By carefully assessing these factors, you can select a home that supports both your personal and professional life.

Pros and Cons of Home Ownership

Now, it’s vital to weigh the pros and cons of home ownership before making a decision. Here are some key points to consider:

| Pros | Cons |

|---|---|

| Building equity over time | High upfront costs |

| Stability and control over your living environment | Maintenance and repair responsibilities |

| Potential tax benefits | Market fluctuations can affect value |

| Customization and personalization options | Long-term financial commitment |

| Ability to generate rental income | Restrictions from HOAs (if applicable) |

Advantages for Medical Professionals

An advantage for you as a medical professional is the potential for stable income, allowing you to qualify for favorable mortgage terms. Your established career may provide you with additional leverage in the housing market. Furthermore, owning a home can be a smart investment, benefiting you as you look to balance work and personal life over time.

Potential Drawbacks

To fully assess home ownership, you must recognize the potential drawbacks. Owning a home comes with responsibilities that may divert your focus away from your professional obligations.

Home ownership entails ongoing costs and commitments, such as maintenance, property taxes, and insurance. These financial obligations can add pressure, especially during demanding periods of your medical career. Additionally, the need to sell a property during a downturn can limit your financial flexibility. Weighing these factors is vital for you, as a busy medical professional, to ensure that home ownership aligns with your lifestyle and financial goals.

Common Mistakes to Avoid

Unlike other professions, doctors often overlook crucial details during the home buying process. You may get caught up in the excitement of purchasing a new home, leading to hasty decisions or underestimating the importance of various factors. Pay attention to your budget, research the market thoroughly, and ensure that you have a clear understanding of the home’s condition and potential hidden costs to navigate this process successfully.

Pitfalls in the Buying Process

Assuming that the first offer you find is the best one can lead to regret later. It’s vital to conduct thorough research and compare multiple options. Additionally, rushing into decisions without a solid understanding of your needs and financial limits can result in setbacks. Take your time to evaluate each choice carefully and consult with professionals to guide you effectively.

Misunderstandings About Financing

About financing, it’s easy to underestimate the complexities involved. Many buyers presume they understand mortgage terms and jargon, but this can lead to confusion and unexpected expenses. Ensure you are well-informed about different financing options, interest rates, and the implications of each choice for your budget and long-term financial health.

Process your financing options meticulously to avoid common misconceptions. Familiarize yourself with fixed-rate vs. adjustable-rate mortgages, and understand how your credit score impacts your interest rates. Additionally, stay informed about down payment requirements and potential closing costs, as well as any first-time buyer programs that may be available. Knowledge is power in this arena, so seek advice and help from experienced financial advisors to make educated decisions.

Summing up

With these considerations in mind, you can navigate the home buying process with confidence and clarity. By understanding your financial position, researching the market, and engaging professionals who specialize in assisting doctors, you can make informed choices that align with your unique needs. Each step you take will guide you closer to finding your ideal home, ensuring that the experience remains enjoyable and rewarding. Take your time, do your due diligence, and soon you’ll be on your way to creating a space that reflects your lifestyle and aspirations.