Guide yourself through the complexities of physician home loan programs with this comprehensive resource designed specifically for you. As a medical professional, you’re faced with unique financial challenges, and understanding these loan options can make a significant difference in your home-buying experience. In this guide, you’ll discover valuable insights and tips that will empower you to make informed decisions about financing your dream home. Whether you’re a resident or an established physician, you’ll find the necessary information needed to navigate the home loan landscape with confidence.

The Unique Financial Landscape for Physicians

You navigate a distinctive financial terrain shaped by your medical education, training, and potential income. While your earning prospects are significantly higher than average, your financial journey often begins with substantial student debt, placing you in a unique situation compared to other professions. Understanding these dynamics helps you make informed decisions regarding home buying, investments, and debt management throughout your career.

High Debt Levels and Income Potential

Your medical education often involves financing that leads to high debt levels, with average student loans exceeding $200,000. Despite those burdens, starting salaries for most physicians remain impressive, often ranging from $150,000 to $300,000. This financial paradox can affect your loan eligibility and home-buying opportunities, necessitating a tailored approach to mortgage solutions.

The Impact of Student Loan Debt on Home Buying

Student loan debt can significantly influence your home buying process, particularly regarding how lenders assess your financial health. High monthly payments can limit your borrowing capacity, making it more challenging to secure favorable mortgage terms. As lenders typically consider your debt-to-income ratio, managing student loan payments effectively is imperative when preparing for home ownership.

For instance, if you carry a monthly student loan payment of $2,000, this can consume a substantial portion of your disposable income, restricting your ability to qualify for a mortgage or leading to higher interest rates. However, specific physician loan programs take into account the potential for future earnings, often allowing for higher debt-to-income ratios than conventional loans. Understanding these nuances in your financial profile empowers you to approach home buying with confidence, ensuring you make the most of the unique opportunities available to you.

Insider Insights: How Physician Home Loan Programs Work

Physician home loan programs are tailored mortgage solutions designed specifically for medical professionals. They take into consideration the unique financial challenges you face, such as high student loan debt and less conventional income trajectories. These loans streamline the approval process and often provide more favorable terms than traditional mortgage options, making it easier for you to transition into homeownership, even if you’re just starting your career.

Key Features that Differentiate Physician Loans

Various attributes set physician loans apart from standard mortgages, tailoring them to fit your specific needs as a medical professional.

- Higher loan-to-value ratios, often up to 100% financing without private mortgage insurance (PMI)

- Flexible debt-to-income ratios that account for your expected higher income

- Deferred student loan payments not counted against your qualifying income

- Customizable loan varieties, including both fixed and adjustable-rate mortgages

- Lower credit score minimums than traditional loans

Perceiving these distinctive features can empower you to make more informed financial decisions regarding your home purchase.

Common Myths Debunked

Unfounded beliefs surrounding physician loans often deter you from exploring your options fully. Many think these loans are only for newly minted physicians, while in fact, they’re available to any medical professional, including residents and established doctors. Misconceptions about eligibility criteria can also lead to missed opportunities. Others assume that physician loans come with hidden fees or unfavorable terms, but most reputable programs offer transparent terms specifically designed to cater to your needs.

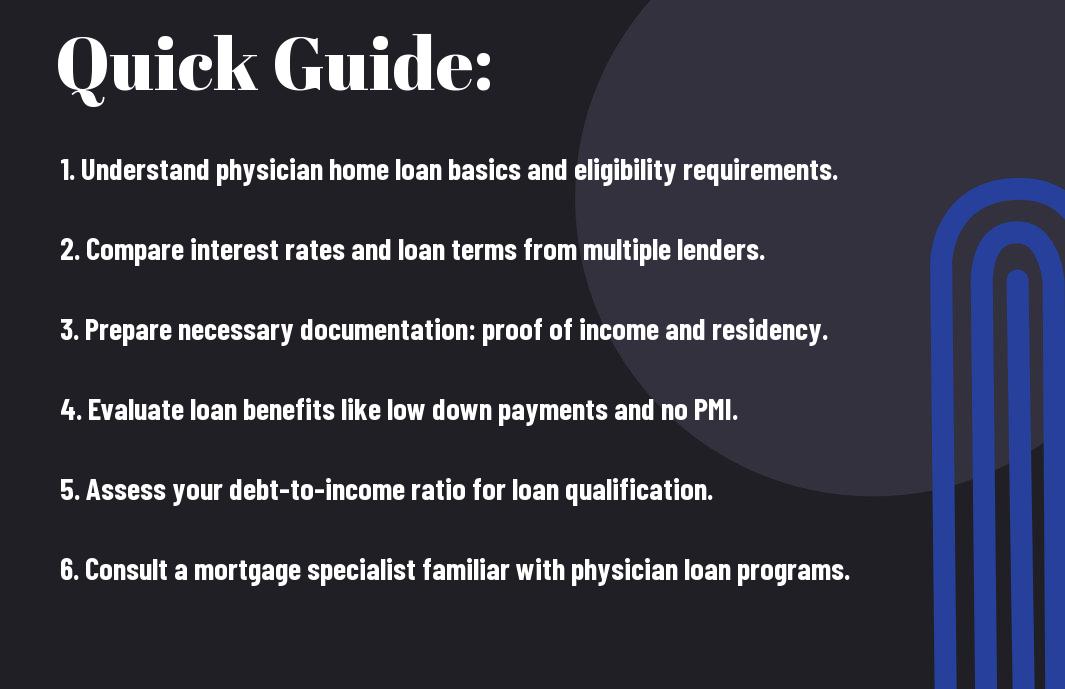

Navigating the Application Process: A Step-by-Step Guide

| Step | Description |

|---|---|

| 1. Research Lenders | Identify lenders specializing in physician home loans to find competitive terms and rates. |

| 2. Gather Documentation | Compile necessary financial documents such as income verification and personal identification. |

| 3. Complete Application | Fill out the loan application form accurately, ensuring transparency with your financial details. |

| 4. Pre-approval | Obtain pre-approval to understand your budget and strengthen your buying position. |

| 5. Close the Loan | Finalize the loan details, signing documents, and making any necessary payments. |

Essential Financial Documentation

Providing thorough financial documentation is crucial for a smooth application process. Expect to submit items like your last two years of W-2s, recent pay stubs, bank statements, and a detailed breakdown of any existing debts. Being organized will not only expedite the evaluation process but can also enhance your credibility as a borrower.

Understanding Credit Requirements and Rates

Your credit score plays a significant role in determining your loan eligibility and interest rates. Most physician home loan programs maintain a minimum score threshold of around 700, although some may be more flexible. A higher score generally translates to better rates, which can save you thousands over the life of the loan.

Loan programs tailored for physicians often consider your unique circumstances—such as the potential for future earnings and limited credit history due to extensive education. You might qualify for rates as low as 3%-4%. If your score falls below the standard, inquire about alternative options that may involve lower down payment requirements or reduced income verification. Some lenders even have programs that factor in your future earning potential, blending education with lending. This bespoke approach can be advantageous, catering to the lifestyle of new physicians entering their careers.

Crafting Your Home Buying Strategy as a Physician

As a physician, developing a robust home buying strategy involves understanding both your unique financial situation and the local real estate market. Consider your long-term career goals, whether they’re tied to geographic locations or specific institutions, to shape your decisions. Creating a comprehensive financial plan that outlines your budget and assesses total costs associated with homeownership will empower you to make informed choices that align with your lifestyle and professional trajectory.

Timing the Market: When to Buy

The ideal time to purchase a home can vary significantly based on market conditions. Typically, spring and summer lead to an uptick in home listings, providing more options. However, winter may offer less competition and better negotiating positions. Pay close attention to local trends, interest rates, and housing inventories to pinpoint the best time for your circumstances. For instance, in a market where rates are projected to rise, acting sooner might be beneficial.

Smart Negotiation Tactics for Physicians

Your status as a physician can enhance your negotiating power in real estate transactions. Sellers often perceive doctors as reliable buyers, which can work in your favor during price discussions. Use this to your advantage by demonstrating your knowledge of the market and preparing to make a competitive offer that reflects current valuations. Initiating conversations around contingencies, repair requests, or closing costs can also help secure favorable terms without alienating sellers. Consider leveraging your lender’s insights on the local housing market to strengthen your negotiating stance.

Engaging in negotiations requires confidence and a clear understanding of your needs. By being well-prepared, you position yourself to assertively express what you want. Compile comparable sales data to bolster your arguments with factual evidence during negotiations. Tailoring your offer based on the seller’s circumstances can also offer leverage; for instance, if a seller is under time constraints to move, a flexible closing date can make your offer stand out. Ultimately, knowing your budget ceiling and remaining unafraid to walk away if necessary allows you to navigate this process with confidence.

The Long-term Financial Implications of Physician Loans

Utilizing physician loans can significantly impact your financial future, particularly as they often offer unique terms that traditional mortgages do not. By allowing you to finance your home with minimal or no down payment and without Private Mortgage Insurance (PMI), these loans can enhance your cash flow, enabling you to allocate funds towards investments, retirement savings, or other financial goals. Understanding these implications is vital for making informed decisions that align with your long-term wealth creation strategies.

Building Wealth through Real Estate

Owning property can be a powerful strategy for building wealth, particularly in high-demand areas where you practice. By investing in real estate, you not only secure a home but potentially create an income-generating asset. Over time, property value appreciation and rental income can contribute to a substantial net worth. Many medical professionals have successfully navigated this path, leveraging physician loans to acquire properties earlier—when prices may be more favorable.

Factors Influencing Future Property Value

Numerous factors can influence the future value of your property. Local economic growth, demand for housing, school district ratings, and proximity to hospitals play significant roles in determining property appreciation. Staying aware of these factors allows you to make savvy investment decisions. Assessing local market trends and demographic shifts can also provide insights that guide your timing and strategy regarding home purchases or sales. This proactive approach enhances your potential returns on real estate investments.

- Location and community amenities

- Quality and reputation of local schools

- Job growth and economic stability in the area

- Urban development and infrastructure improvements

- Real estate market trends and fluctuations

Understanding the implications of these factors can shape your long-term planning. Larger economic trends such as population growth or changes in employment sectors might indicate whether an area is on the rise or decline. Timing your purchase or considering renovations based on future projections can elevate your investment. Additionally, as you gather information about your local market, you can build a portfolio of properties that appreciate more substantially. This knowledge is invaluable in optimizing your real estate strategy.

- Research urban revitalization projects

- Analyze historical trends in your suburban area

- Stay updated with local housing inventory

- Consult industry reports on real estate forecasts

- Network with local real estate professionals

This comprehensive approach minimizes financial risks while maximizing rewards in your journey as a homeowner and investor. By leveraging insights into your chosen market, you’re equipped to make well-informed decisions that foster financial growth.

To wrap up

Taking this into account, navigating physician home loan programs can significantly benefit your financial journey as a doctor. By understanding the unique advantages and requirements of these loans, you can make informed decisions that align with your goals. This guide serves as an vital resource for your journey, ensuring you have the knowledge needed to secure the right home financing options for your needs. Embrace this opportunity to pave a smoother path toward homeownership while focusing on your medical career.