You are about to begin on a journey through the world of doctor loan programs, tailored specifically for medical professionals like yourself. This comprehensive guide will equip you with the knowledge needed to navigate these unique financing options, helping you make informed decisions when it comes to purchasing your first home or refinancing existing loans. With insights on eligibility requirements, benefits, and potential challenges, you’ll gain a deeper understanding of how these specialized loan programs can support your financial goals and enhance your home-buying experience.

Types of Doctor Loan Programs

A variety of doctor loan programs are designed specifically for medical professionals like you. These programs cater to your unique financial situations and offer numerous benefits. Below is a breakdown of the different types:

| Loan Type | Key Features |

|---|---|

| Conventional Loans | Lower interest rates and lower down payment options. |

| FHA Loans | Lower credit requirements, allowing for flexible qualifying conditions. |

| VA Loans | No down payment options for eligible veterans, along with lower interest rates. |

| Jumbo Loans | For higher loan amounts, typically not covered by conventional loans. |

| State-Specific Programs | Tailored offerings based on the state you practice in. |

The unique features of these loan programs can support you as you transition into a successful medical career.

Conventional Loans

Conventional loans are a popular choice for medical professionals seeking home financing. They typically require a higher credit score and a more substantial down payment compared to other loan options. However, these loans can provide you with lower interest rates and conventional terms that may save you money long-term.

FHA and VA Loans

While FHA and VA loans offer beneficial terms for medical professionals, they cater to different needs. FHA loans provide a pathway for those with lower credit scores, enabling you to qualify for a home loan with a minimal down payment. VA loans, on the other hand, serve veterans and active-duty service members, offering no down payment and favorable interest rates.

Programs such as FHA and VA loans are tailored to support you in achieving homeownership despite your student debt or limited credit history. By taking advantage of these options, you can secure a loan that aligns with your financial situation, allowing you to focus on your medical career without the stress associated with financing your first home.

Step-by-Step Guide to Applying for a Doctor Loan

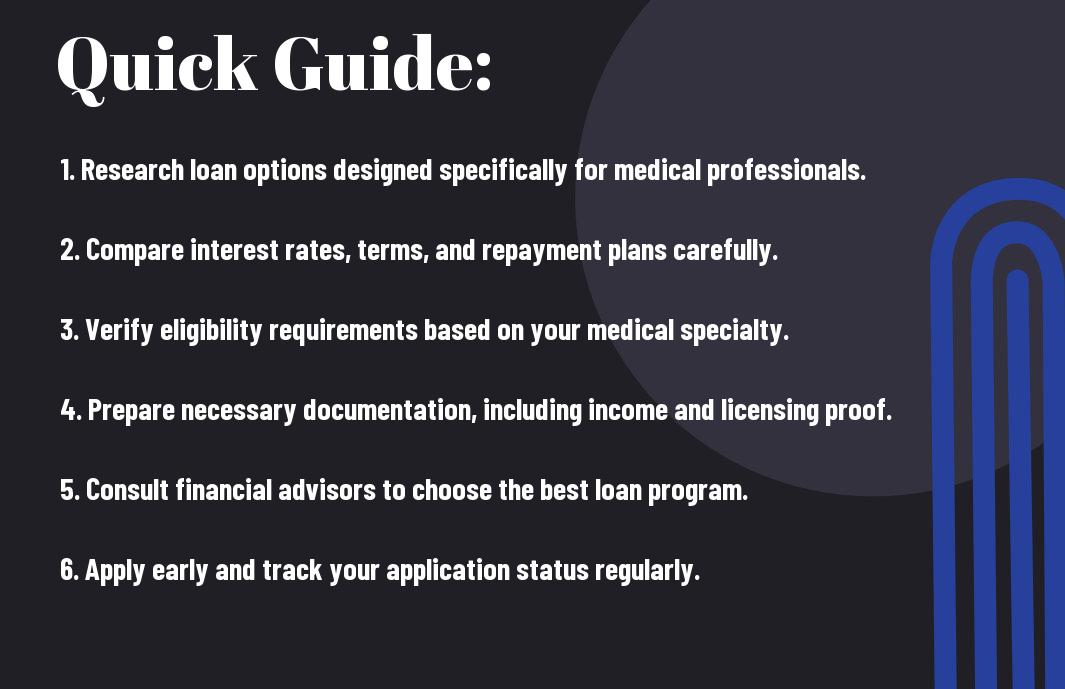

Even though applying for a doctor loan might seem daunting, breaking the process down into manageable steps will help you navigate it more smoothly. Start by assessing your financial situation, preparing required documentation, and exploring lender options. Below is a simple guide to help you understand each step clearly.

Step-by-Step Application Process

| 1. Assess Your Financial Situation | Understand your income, expenses, and credit score. |

| 2. Prepare Required Documentation | Gather vital financial documents. |

| 3. Explore Lender Options | Research and compare different lenders offering doctor loans. |

| 4. Submit Your Application | Complete and submit your loan application. |

| 5. Await Approval | Monitor your application status and be prepared for follow-up. |

Assessing Your Financial Situation

The first step in applying for a doctor loan is to assess your financial situation. This involves reviewing your income, monthly expenses, savings, and credit score. Understanding where you stand financially will help you determine how much you can afford and identify areas that might need improvement before proceeding with the loan application.

Preparing Required Documentation

Situation varies for every applicant, but certain documentation is typically required when applying for a doctor loan. You will need to provide proof of income, tax returns, bank statements, and potentially your employment contract. Gathering these documents early will streamline your application process and help facilitate a more efficient review by lenders.

Applying for a doctor loan requires you to have your documentation in order to strengthen your application. To prepare, start compiling your most recent pay stubs, W-2 forms, and if applicable, evidence of residency or fellowship income. This proactive approach not only increases your chances of approval but also makes collaboration with your lender much smoother, as they will require these materials to evaluate your financial profile thoroughly.

Key Factors to Consider

All medical professionals seeking a loan must weigh several key factors to ensure they choose the best program for their situation:

- Your loan amount requirements

- The loan program’s interest rates

- Your creditworthiness and credit score

- Debt-to-income ratio

Recognizing these elements will help you make an informed decision that aligns with your financial goals.

Credit Score

On your journey to securing a doctor loan, understanding your credit score is crucial. A higher credit score can significantly improve your chances of getting favorable loan terms, including lower interest rates. Before applying for a loan, ensure that you review your credit report and address any discrepancies that could impact your score.

Debt-to-Income Ratio

An additional factor to consider is your debt-to-income (DTI) ratio. Lenders often use this ratio to evaluate your ability to manage monthly payments and repay debts.

Ratio is calculated by dividing your total monthly debt payments by your gross monthly income. A lower DTI signifies a better financial standing, making you a more attractive candidate for a loan. Aim for a DTI below 43% to increase your chances of approval, as lenders typically view this as an indicator of financial responsibility. Financial stability can help you secure better loan options tailored to your needs.

Tips for Securing the Best Terms

Despite the various options available, securing the best terms for your doctor loan program requires diligence and strategy. Focus on these key steps:

- Research multiple lenders to compare rates and terms.

- Maintain a strong credit score to enhance your negotiation power.

- Provide comprehensive documentation of your income and financial situation.

- Consider making a larger down payment if possible.

Knowing how to effectively present your financial profile can lead to better loan agreements.

Shopping Around for Lenders

Assuming you take the time to shop around, you’ll likely discover varying terms and interest rates from different lenders. Evaluating a range of options allows you to identify the best deal tailored to your financial needs.

Understanding Loan Terms

Clearly, understanding the nuances of loan terms is crucial for informed borrowing. Terms like interest rates, repayment periods, and fees can significantly impact your overall financial experience.

Tips for navigating loan terms include taking time to read the fine print carefully. Pay attention to interest rates—fixed versus variable—and their impact on monthly payments. Understand the total cost of the loan, including any origination or processing fees. Additionally, be aware of prepayment penalties and the terms associated with them, as this could affect your ability to pay off the loan early without incurring extra costs. Knowing these details will empower you to make well-informed decisions and secure favorable loan conditions tailored to your unique career as a medical professional.

Pros and Cons of Doctor Loan Programs

Once again, understanding the pros and cons of doctor loan programs is crucial for making an informed decision tailored to your financial needs. Below is a breakdown of the advantages and disadvantages you may encounter.

Pros and Cons Overview

| Pros | Cons |

|---|---|

| No PMI requirement | Higher interest rates |

| Low down payment options | Limited lender options |

| Designed for medical professionals | May require proof of employment |

| Flexible debt-to-income ratios | Higher loan amounts may lead to debt |

| No prepayment penalties | Potential for stricter credit guidelines |

Advantages

Now, one of the notable advantages of doctor loan programs is the ability to secure a mortgage without the need for PMI, which can save you money over the life of the loan. Additionally, many programs offer low down payment options, allowing you to purchase a home without a substantial upfront investment. Tailored specifically for medical professionals, these loans consider your unique financial situation, offering flexibility in terms of debt-to-income ratios.

Disadvantages

On the other hand, doctor loan programs can present certain disadvantages that you’ll want to consider. Higher interest rates compared to conventional loans can result in increased monthly payments. Additionally, your lender options may be limited, and requirements for proof of employment can add complexity to the application process.

Disadvantages can also extend to the potential for incurring significant debt if you opt for a higher loan amount, which may be tempting given your professional earning potential. You might find that stricter credit guidelines are enforced, limiting accessibility to those with less-than-stellar credit. Therefore, while doctor loan programs offer distinct benefits, weighing these factors against possible drawbacks is crucial for your long-term financial health.

Frequently Asked Questions

After exploring the ins and outs of doctor loan programs, you may still have some lingering questions. This section addresses the most common inquiries medical professionals have, helping you gain clarity on aspects like loan qualifications, repayment options, and how these programs impact your financial journey. Let’s investigate the details to ensure you are fully informed.

Eligibility Requirements

While each lender may have unique criteria, most doctor loan programs are designed specifically for medical professionals, including physicians, dentists, and certain health practitioners. You typically need to provide proof of your medical degree, current employment status, and sometimes a minimum income or a residency contract. Understanding these eligibility requirements can help streamline your application process.

Common Misconceptions

Now that you know about eligibility, it’s important to address some common misconceptions surrounding doctor loan programs. Many people believe that these loans are only available to those with a high income or established credit history, but this isn’t always the case. In fact, these loan options often cater to new graduates, allowing you to secure financing even if you’re just starting out in your career.

Understanding these misconceptions can empower you to make informed decisions about your financial options. You might think that doctor loans require a hefty down payment, but many programs allow for little to no down payment, making homeownership more accessible. Additionally, some believe that these loans come with higher interest rates; however, competitive rates are often offered specifically to support medical professionals. By dispelling these myths, you can better navigate your financing options and find the right program for your needs.

To wrap up

Considering all points, understanding doctor loan programs can significantly benefit you as a medical professional. These specialized financing options are designed to meet your unique needs, allowing you to navigate the complexities of purchasing a home or securing funding for practice. By being informed about the various programs available, their requirements, and potential advantages, you can make empowered financial decisions that align with your career trajectory and personal goals. Equip yourself with this knowledge to maximize your opportunities in the housing market.