This guide provides you with a comprehensive approach to applying for a doctor loan, assisting you from the initial pre-approval phase all the way to closing. As a medical professional, understanding the unique benefits and requirements of doctor loans can be key to securing your financial future. We’ll walk you through each vital step, offering insights and expert advice to ensure a seamless application process. Empower yourself with the right knowledge and strategies to navigate the landscape of doctor loans with confidence.

Types of Doctor Loans

While exploring your options for doctor loans, you’ll find they come in several types that cater to different needs:

- Conventional Doctor Loans

- FHA Doctor Loans

- VA Doctor Loans

- Jumbo Doctor Loans

- State or Local Physician Programs

The right choice depends on your financial situation, credit score, and the type of property you want to purchase.

| Conventional Doctor Loans | Standard loans not backed by government programs, typically requiring a higher credit score. |

| FHA Doctor Loans | Insured by the Federal Housing Administration, catering to first-time homebuyers with lower credit limits. |

| VA Doctor Loans | Available for veterans and active military personnel, often without a down payment. |

| Jumbo Doctor Loans | For high-value properties that exceed conventional loan limits, generally requiring solid credit. |

| State or Local Physician Programs | Special loans specific to your state or locality, often offering unique benefits for medical professionals. |

Conventional Doctor Loans

While conventional doctor loans can be suitable for many healthcare professionals, they generally expect a strong credit profile and a larger down payment compared to other types of loans. This option typically allows for more flexibility in loan amounts, so it is a great choice if you’re looking to purchase a higher-value property.

FHA and VA Options

Now, if you’re looking for financing options with lower down payment requirements, FHA and VA loans may be attractive for you. FHA loans are designed to help first-time buyers enter the housing market, while VA loans are available to eligible veterans and active-duty service members, often featuring no down payment and favorable terms.

To further explore FHA and VA options, keep in mind that both types of loans offer unique benefits tailored to your specific situation. FHA loans typically require a lower credit score and down payment as low as 3.5%, making them ideal for those just starting their repayment journey. VA loans, on the other hand, can eliminate the need for a down payment altogether, allowing you to focus your funds on moving and settling into your new home without the burden of hefty upfront costs.

Factors to Consider When Applying

If you are considering applying for a doctor loan, several factors influence your eligibility and overall loan experience. Key aspects to evaluate include:

- Your credit score

- Your debt-to-income ratio

- The loan amount you need

- The terms and conditions of the loan

- Your employment status

After addressing these factors, you’ll be better prepared for the application process.

Credit Score Requirements

When applying for a doctor loan, your credit score plays a significant role in determining your loan eligibility and interest rates. Most lenders prefer applicants with a score of at least 700, as this indicates responsible credit behavior and lower risk. Higher scores can unlock better loan terms, making it important to know your credit standing before you apply.

Debt-to-Income Ratio

One of the most important financial metrics considered by lenders is your debt-to-income (DTI) ratio. This ratio compares your monthly debt payments to your gross monthly income, reflecting your ability to manage monthly payments. Ideally, your DTI should be below 43%, though some lenders may allow higher ratios depending on your overall financial profile.

Applying for a doctor loan requires you to present a solid debt-to-income ratio to enhance your chances of approval. An ideal DTI demonstrates your ability to efficiently manage your financial obligations while repaying the loan. When calculating your ratio, include all monthly debt payments such as student loans, car loans, and credit card bills. The lower your DTI, the more attractive you may appear to lenders, thereby improving your chances of securing favorable loan options.

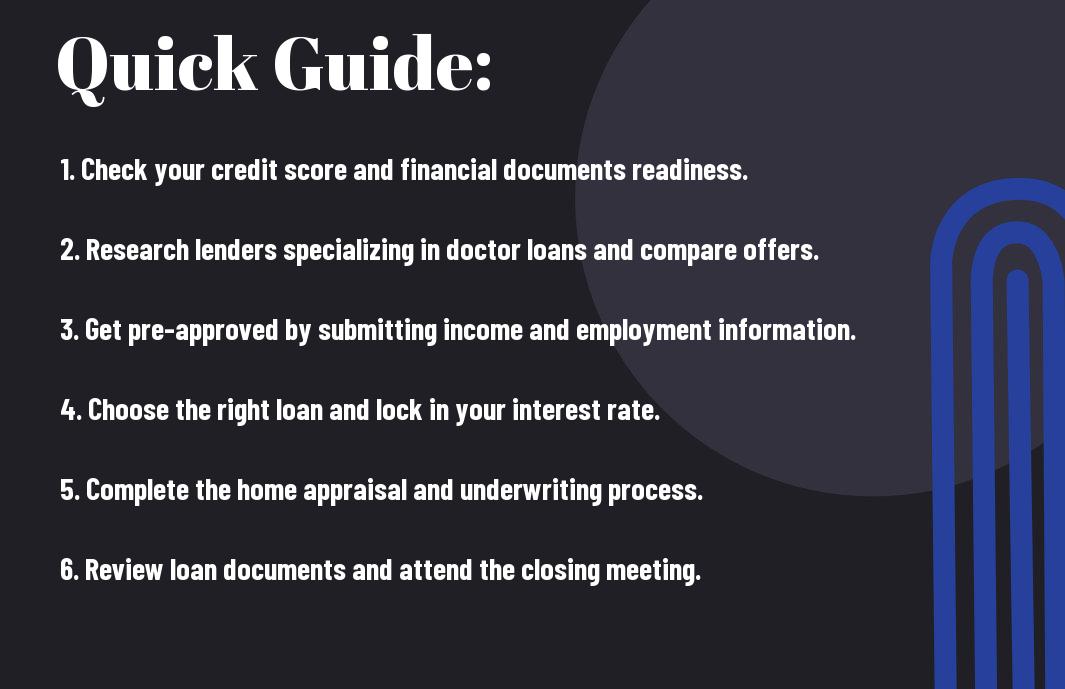

Step-by-Step Application Process

All prospective borrowers must navigate a structured application process to secure a doctor loan. This process is broken down into key stages, ensuring you understand and complete each requirement efficiently:

| Stage | Description |

|---|---|

| Pre-Approval | Gather financial documents and submit a preliminary application to determine your eligibility. |

| Finalizing Your Application | Submit additional documentation and finalize details with your lender before closing. |

Pre-Approval Process

The pre-approval process is vital as it provides an estimate of how much you can borrow based on your financial situation. You will typically need to submit documents such as pay stubs, tax returns, and student loan information to assess your eligibility for the doctor loan program.

Finalizing Your Application

Little details can make a significant impact when finalizing your application. You’ll need to provide any additional documents requested by your lender, such as verification of employment or assets, and clarify any discrepancies in your financial profile.

Process your application with diligence by ensuring all required documentation is submitted promptly. Be prepared for interviews or discussions with your lender to finalize any remaining details. This is the stage where they will assess your preparedness for closing, guiding you through the last steps until you secure your loan.

Tips for a Successful Application

Now that you’re on your way to applying for a doctor loan, here are some tips to enhance your application:

- Stay organized with your financial documents.

- Be honest about your financial situation.

- Improve your credit score if needed.

- Research lenders who specialize in doctor loans.

- Prepare to answer detailed questions about your income.

Recognizing these factors will help position you for a favorable outcome.

Preparing Your Financial Documents

If you want to make your application process smoother, start gathering your financial documents early. Ensure you have your tax returns, pay stubs, bank statements, and any student loan information readily available to avoid delays.

Communicating with Lenders

Your approach to communicating with lenders can make a significant difference in your application experience. Maintaining open lines of communication with your lender helps you stay informed about the process and any necessary steps you may need to take.

Tips for effective communication include preparing a list of questions before meetings, being clear and concise in your discussions, and responding promptly to requests for information. This proactive engagement not only demonstrates your commitment but can also improve your chances of a smoother application process.

Pros and Cons of Doctor Loans

For many physicians, understanding the advantages and disadvantages of doctor loans is key to informed decision-making. The following table breaks down the pros and cons of these specialized loans:

| Pros | Cons |

| Lower down payment options | Higher interest rates |

| No private mortgage insurance (PMI) | Limited loan types |

| Flexible debt-to-income ratios | Potentially lower loan amounts |

| Loan forgiveness options | Higher requirements for approval |

| Faster processing times | May only be available to specific medical professionals |

Advantages of Doctor Loans

Loans designed for doctors offer unique benefits tailored to your profession. You can enjoy lower down payment requirements, often as low as 0-5%, and the absence of private mortgage insurance (PMI), which helps reduce monthly costs. Additionally, you may find more lenient debt-to-income ratio assessments, allowing you to qualify despite student loans. Many lenders also provide loan forgiveness options for qualifying borrowers, and processing times can be quicker compared to conventional loans.

Potential Drawbacks

One notable drawback of doctor loans is the likelihood of higher interest rates compared to traditional mortgage options. This can lead to larger overall payments and higher long-term costs. Furthermore, certain loan types might be limited, restricting your choices. You may also face lower loan amounts compared to what’s available through conventional lending. Approval processes might be more stringent, requiring specific documentation or qualifications, and not all lenders cater to every type of medical professional, potentially limiting your options.

It’s important to evaluate these potential drawbacks based on your financial situation and future plans. While a doctor loan can be beneficial, the higher interest rates might not be worth the savings on down payments in the long run. Additionally, if your medical specialty isn’t well-represented, finding the right lender could pose a challenge. Consider working with a knowledgeable mortgage advisor to navigate these factors effectively and make the best choice for your circumstances.

Frequently Asked Questions

After exploring the process of applying for a doctor loan, you may have some lingering questions. This section addresses common concerns and provides you with the information needed to feel confident in taking the next steps towards your homeownership journey. Whether you’re curious about eligibility requirements or the application process, we’re here to help clarify any uncertainties you may have.

Common Misconceptions

Misconceptions about doctor loans often create confusion for first-time applicants. Many people believe that these loans are only reserved for specific medical professionals or come with limited benefits. However, doctor loans are designed to accommodate a wide range of medical professionals, providing flexible terms and down payment options tailored to your unique situation.

Clarifying Loan Terms

If you’re uncertain about various loan terms, understanding them can significantly influence your decision-making process. You’ll encounter jargon related to interest rates, loan limits, and repayment schedules that may seem daunting but are important to grasp.

Another key aspect of clarifying loan terms is understanding how they impact your financial situation. For instance, knowing the difference between fixed and adjustable rates can affect your monthly payments and long-term costs. Additionally, familiarize yourself with terms like loan-to-value ratio and debt-to-income ratio, as they play a role in your loan approval and overall affordability. Clarifying these terms ensures you make informed decisions tailored to your financial goals.

Conclusion

On the whole, navigating the Doctor Loan application process can be seamless when you follow this step-by-step guide from pre-approval to closing. By understanding each phase, you can make informed decisions that align with your financial goals. You should feel empowered to engage with lenders, provide necessary documentation, and secure the best loan terms for your unique situation. With diligence and preparation, you are well on your way to homeownership that supports your professional journey.