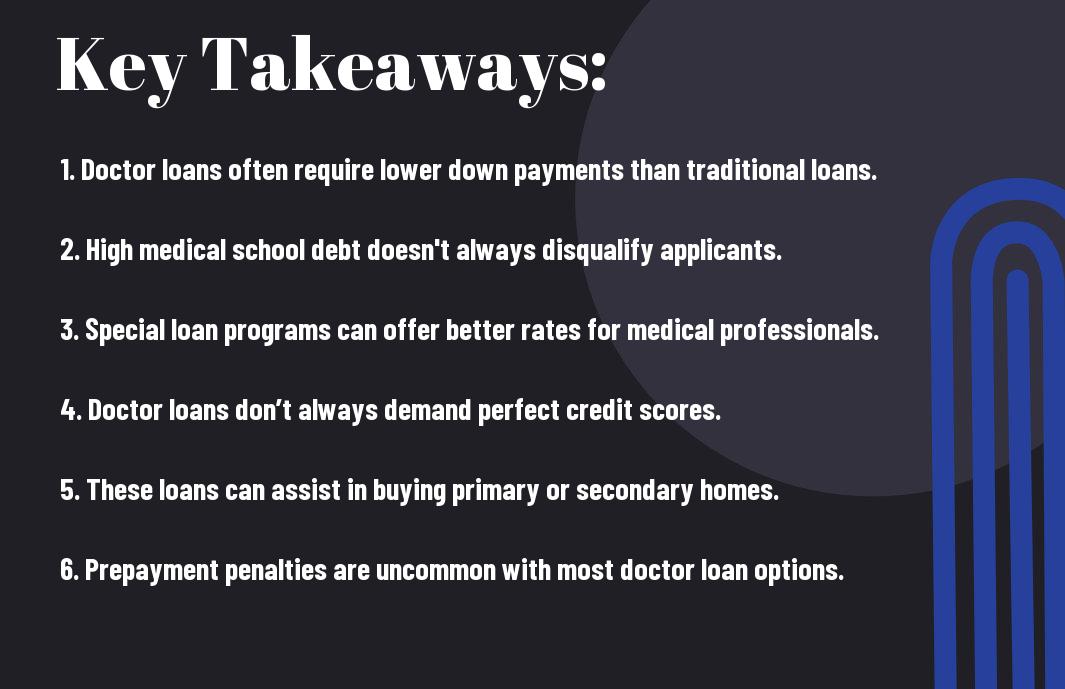

Many prospective borrowers in the medical field hold misconceptions about doctor loans that can affect their financial decisions. It’s important to understand the truth behind these myths to make the best choices for your future. Whether you’re a resident, fellow, or established physician, clearing up these misconceptions will empower you to navigate the landscape of doctor loans effectively. Here, you’ll find the information you need to debunk common myths and optimize your financial strategy.

Understanding Doctor Loans

Before you probe the specifics, it’s imperative to grasp the concept of doctor loans and how they fit into your financial toolkit. These specialized loans cater to the unique needs of medical professionals, offering favorable terms and lower down payment options, enabling you to secure your financial future with ease.

Definition and Purpose

Purpose of doctor loans is to provide financial assistance tailored for medical professionals, allowing for home purchasing or refinancing options that traditional loans may not accommodate. This ensures that you can focus on your medical career while also achieving your homeownership goals without the typical barriers faced by other buyers.

Types of Doctor Loans

By understanding the different types of doctor loans available, you can make informed decisions about which loan may be best suited for your needs. Here are some common types:

| Loan Type | Description |

|---|---|

| Conventional Doctor Loans | Standard loans with favorable terms for doctors. |

| FHA Loans | Government-backed loans with low down payments. |

| VA Loans | No down payment options for veterans. |

| Jumbo Loans | Loans designed for high-value properties. |

| Low Documentation Loans | Loans requiring minimal paperwork for quicker approval. |

Consequently, perceiving the differences between these types will empower you to choose the best loan for your financial situation. Each option has distinct benefits depending on your career stage and financial goals.

- Conventional loans offer standard terms for stable employment.

- FHA loans cater to those needing lower initial investments.

- VA loans provide great options for military professionals.

- Jumbo loans are excellent for those purchasing luxury homes.

- Low documentation loans simplify the borrowing process.

Ultimately, understanding these diverse doctor loan options is key in guiding your financial decisions, enabling you to leverage opportunities that align with your career trajectory and lifestyle.

Myth 1: High Income Guarantees Loan Approval

There’s a common misconception that simply having a high income guarantees approval for a doctor loan. While a solid income certainly plays a significant role in your application, lenders also assess other factors such as your credit score, debt-to-income ratio, and employment history. It’s important to present a well-rounded financial profile to enhance your chances of securing that loan. So, even if you earn a high salary, don’t overlook these other key elements that can impact your approval status.

Myth 2: Doctor Loans Always Require a Down Payment

Some people believe that doctor loans always require a down payment, but that’s not the case. Many lenders offer specialized physician mortgage programs that allow you to finance 100% of your home purchase. This means you can secure a loan without having to put down any money upfront. By understanding the details of these programs, you can take advantage of this opportunity to achieve homeownership sooner than you might expect, easing the burden of substantial upfront costs common in traditional mortgages.

Myth 3: Doctor Loans Are Only for New Grads

While many believe that doctor loans are exclusively for recent graduates, this isn’t true. Whether you are just starting your career or have years of experience under your belt, these loans can be tailored to meet your needs. In fact, many lenders offer specialized programs for doctors at various stages in their careers, including those in residency, fellowship, and even established practitioners looking to refinance or purchase a home. Understanding your options can help you take full advantage of these financial opportunities, regardless of how long you’ve been practicing.

Myth 4: All Doctor Loans Have the Same Interest Rates

Despite what you may have heard, not all doctor loans come with the same interest rates. Lenders often offer different rates based on a variety of factors, including your credit score, debt-to-income ratio, and the specific terms of the loan. It’s imperative that you shop around and compare offers from multiple lenders to find the most favorable interest rate for your situation. By doing so, you can potentially save a significant amount of money over the life of the loan.

The Benefits of Doctor Loans

To fully appreciate the advantages of doctor loans, you should consider how these specialized financial products cater specifically to your unique needs as a medical professional. You often face high educational debt and a delayed earning potential; doctor loans typically offer lower down payment requirements and reduced interest rates, making homeownership more accessible. Additionally, these loans are designed to consider your future earning potential, allowing you to qualify for larger amounts even if you are fresh out of residency. This means you can secure your dream home sooner than you might with other conventional loan options.

Final Words

Ultimately, understanding the truth about doctor loans can empower you to make informed financial decisions. By debunking common myths, you can recognize the benefits and limitations of these specialized loans, ensuring that you choose the best option for your unique situation. By arming yourself with accurate information, you’ll be better prepared to navigate your journey toward homeownership as a medical professional.