Mortgage programs designed for physicians accelerate your home purchase by allowing lower down payments, relaxed underwriting for residency income, and consideration of future earnings rather than only current liabilities. By matching loan features to your career stage-resident, fellow, or attending-you gain buying power and time flexibility, enabling you to secure competitive interest rates and favorable terms that align with your financial trajectory and help you move into a home sooner.

Understanding Doctor Mortgage Loans

Definition and Overview

Doctor mortgage loans are specialized home mortgages designed for physicians, dentists and other high-earning clinicians in training or early practice; they let you leverage expected future income, employment contracts, and professional status to qualify sooner than conventional loans, often allowing purchase during residency or within the first year of attending practice while carrying substantial student debt.

Key Features and Benefits

You can access lower down payments (often 0-5%), waived private mortgage insurance on many programs, flexible debt-to-income calculations that discount deferred student loans, and higher loan limits-features that accelerate your path to homeownership while you transition from training to practice.

- Low or no down payment options, commonly 0-5% on primary residences.

- PMI often waived even when your down payment is under 20%.

- Underwriting that considers residency/fellowship income and signed employment contracts.

- Flexible treatment of student loans: lenders may use future income or income-based repayment terms rather than raw balances.

- Higher loan limits-many programs support purchases in the $1M-$2M range depending on market.

- Knowing these features helps you compare lenders by how they treat your contract, student debt and required cash to close.

In practice, lenders will review your residency year, match length of contract, and projected attending salary; for example, you might qualify while in PGY-2 with a signed offer for an attending position, enabling you to buy a $400k home with 5% down and no PMI where traditional underwriting would delay eligibility.

- Accelerated qualification using employment letters or future salary projections.

- Varied loan terms: 30-year fixed, 15-year, and ARM options tailored to physician timelines.

- Some programs allow interest-only payments for a short initial period to ease cash flow during training.

- Fewer restrictions on co-signers and greater willingness to close with student loan balances above $150k.

- Knowing how each lender calculates DTI and reserves is key to estimating your true borrowing power.

Eligibility Criteria

You typically qualify based on profession, employment status, and documentation rather than decades-long credit history: lenders offer doctor loans with 0-10% down and loan limits frequently between $1M and $2.5M, account for upcoming attendings’ salaries, and treat residents/fellows differently than established attendings when calculating debt-to-income. Provide an employment or offer letter and proof of graduation or licensure to move faster through underwriting.

Who Qualifies for Doctor Mortgage Loans

You’ll usually see eligibility for MDs, DOs, DDS/DMD, DVM, ODs, and often dentists and podiatrists; many lenders also accept residents, fellows, and recently matched physicians using an offer/match letter. Some programs extend to nurse practitioners, physician assistants, and certain specialists-if you have a signed employment contract or clear path to licensure, you belong in the applicant pool.

Common Requirements and Documentation

You must submit an employment/offer letter, proof of graduation or match, state license or evidence of impending licensure, recent pay stubs or contract, student loan statements, and standard credit/tax documents; lenders often request a 680+ FICO score but can be flexible if your contract guarantees future income. Specifics vary by bank, so your contract terms and start date matter.

For example, if your offer shows a $250,000 starting salary and a July start date, lenders may qualify you using that income even while you’re a $60,000 resident; they commonly use actual student loan payments or a 0.5-1% of the balance for DTI calculations, require the employment start within 90-180 days, and accept deferred student loan status when backed by a solid contract.

Financial Advantages

You gain tangible financial perks that accelerate homebuying: physician loans typically require smaller down payments, offer competitive interest pricing and often waive private mortgage insurance, and they permit higher loan amounts based on future earning potential-letting you buy sooner without the usual 20% barrier or tight conventional limits.

Lower Down Payments

You can often put down as little as 0-5% instead of the conventional 20% to avoid PMI. For example, on a $500,000 home a 0% down physician loan saves you $100,000 up front compared with a 20% down payment, freeing cash for moving costs, loan payments, or closing expenses.

Favorable Interest Rates

You frequently see rates within a few tenths of a percent of conventional mortgages, and lenders may price you slightly better because of projected physician income. For instance, a 0.5% lower rate on a $600,000 30-year loan can cut your monthly principal-and-interest by roughly $150-$200.

Because lenders factor in future earnings and employment contracts, you’re often eligible for fixed-rate terms (30-year or 15-year) or competitive ARMs with lower initial pricing. That $150-$200 monthly saving equals about $2,000 per year and roughly $60,000 over 30 years in nominal payments, plus reduced interest accrual and better cashflow for early career financial moves.

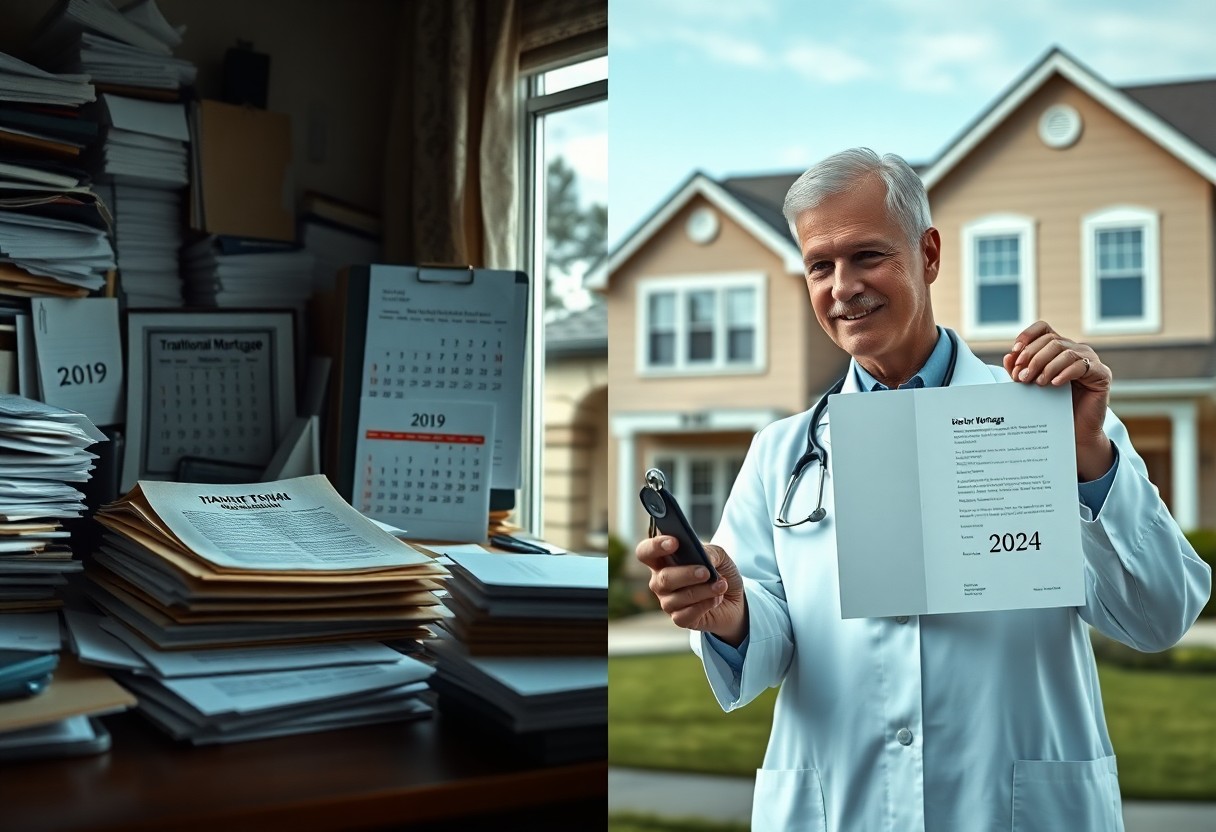

Comparing Traditional Mortgages

When comparing physician loans to conventional mortgages, you should focus on down payment, PMI, income verification, and underwriting flexibility; physician programs often let you put 0-10% down, waive private mortgage insurance on higher LTVs, and qualify using employment letters or residency contracts instead of long credit histories. For a $600,000 purchase, a 5% doctor loan down payment saves you $90,000 up front versus a 20% conventional down payment requirement.

| Doctor Loan | Traditional Mortgage |

|---|---|

| Down payment typically 0-10%; some lenders waive PMI | Down payment commonly 3-20%; PMI required if <20% down |

| Underwriting considers employment letters/residency contracts; flexible on short credit histories | Requires established employment history, longer credit track record |

| DTI allowances often up to ~50%; student loan treatment can be favorable | DTI guidelines usually tighten around 43-45%; student loans calculated conservatively |

| Loan limits frequently higher for high-earning specialties and metro areas | Subject to conforming loan limits or jumbo criteria with stricter overlays |

Differences in Terms and Conditions

You’ll see concrete term differences: physician loans often allow 0-10% down, no PMI at higher LTVs, and flexibility on closing credit blemishes, whereas traditional mortgages usually require stronger credit history, 3-20% down, and automatic PMI under 20% LTV; interest rates for doctor loans are typically within 0.25-0.5% of conventional rates, making them competitive on a 30-year fixed.

Impact on Debt-to-Income Ratios

Your DTI calculation can swing qualification odds: conventional lenders commonly cap DTI around 43-45%, while many physician lenders will accept DTIs up to about 50% and may treat deferred student loans more leniently, which often converts a borderline denial into an approval for larger loan amounts.

For example, if your gross monthly income is $15,000 (annual $180,000) and you have $200,000 in student loans in deferment, a conventional lender might use 1% of the balance as a monthly payment ($2,000) when calculating DTI, limiting your allowable mortgage payment to roughly $4,450 at a 43% cap. A physician loan lender could instead use an employment contract and either exclude the deferred payment or use the actual repayment plan (say $500/month under IBR), raising your available mortgage payment to about $6,500 at a 50% DTI-enough to qualify for a substantially higher purchase price.

Navigating the Application Process

You should expect a focused timeline: pre-approval within days and closing often in 30-45 days if documentation is complete. Lenders typically consider your residency/fellowship contract as qualifying income, may offer 90-100% financing, and use flexible DTI rules (sometimes up to ~50%). Gather contracts, student loan statements, bank statements, and licensing docs early to prevent delays and to let lenders use future earnings when underwriting your file.

Steps to Secure a Doctor Mortgage Loan

Start by getting pre-approved to set clear price limits; then shop lenders experienced with physician programs to compare rates and fees. Assemble key documents: employment/offer letter, student loan statements, recent bank statements, prior tax returns or W-2s, and proof of licensure. Lock a rate when satisfied, complete underwriting quickly by answering requests promptly, and plan for a typical 30-45 day close once conditions are met.

Tips for Successful Approval

Keep your credit utilization under 30% and avoid opening new credit lines before closing; many lenders prefer scores in the 660-720+ range, though some will consider lower with compensating factors. Document any student loan repayment plans-lenders may use either the actual payment or a calculated percentage (often 0.5% of the balance) for DTI. Maintain 1-3 months of liquid reserves to smooth approval and closing.

- Employment/offer letter showing start date, salary, and any signing bonus.

- Student loan statements reflecting current payment status or deferred status.

- Bank statements covering at least two months of liquid assets and reserves.

- Licensing or graduation documents proving professional status and timeline.

- This helps lenders verify your future income and reduces manual underwriting questions.

When student loans are deferred during residency, clarify how the lender will calculate a monthly obligation: some underwriters use the actual monthly contractual payment, others apply a percentage of the balance (commonly 0.5%-1%) for DTI. For example, if you have $200,000 deferred loans, a 0.5% calculation treats the payment as $1,000/month while an actual payment method might use $0-so confirming the method with each lender can change your qualifying power significantly.

- Pay down revolving debt to lower your DTI and improve score behavior.

- Keep documentation organized and respond to underwriting requests within 24-48 hours.

- Choose lenders who regularly underwrite physician loans to avoid misapplied student loan calculations.

- Maintain 1-3 months of reserves in liquid accounts to meet lender overlays.

- This will increase your approval odds and often result in better rates or fewer conditions at closing.

Case Studies and Success Stories

- 1. Emergency medicine resident (PGY-2) used a doctor loan to buy a $520,000 condo with 0% down; loan $520,000 at 3.9% fixed, 30-year term, DTI 38%. Closed in 30 days; monthly P&I ≈ $2,461 vs conventional mortgage ≈ $2,720 (including PMI), and you save an estimated $42,000 in rent by buying 18 months earlier.

- 2. Cardiology fellow purchased a $820,000 single-family home with 3% down ($24,600) using income-flex underwriting; loan $795,400 at 4.1%, 30-year fixed, DTI 35%. Lender waived PMI and approved with residency stipend; monthly P&I ≈ $3,855, enabling earlier equity buildup vs renting.

- 3. First-year attending (internal medicine) bought a $1,150,000 house with 5% down ($57,500) via a physician jumbo program; loan $1,092,500 at 4.25%, 30-year; closed in 45 days. You avoid conventional jumbo underwriting delays and saved roughly $150/month compared to bridge financing while negotiating seller concessions.

- 4. Surgical resident leveraged a $450,000 purchase with 0% down and lender allowance for future attending salary; loan $450,000 at 3.75%, 30-year fixed, DTI 40%. Approved using employment contract; monthly P&I ≈ $2,083 and no PMI, enabling purchase one year into residency instead of waiting for attending position.

- 5. Dual-physician household (two fellows) financed a $980,000 townhouse with a combined doctor loan: 2% down ($19,600), loan $960,400 at 4.0%, 30-year; DTI combined 42%. Financing accepted future faculty appointment contingency; you save an estimated $30,000 in upfront costs vs conventional loans requiring 20% down.

- 6. New attending in pediatrics refinanced an earlier high-rate loan after 18 months: original doctor loan $600,000 at 4.5%, refinanced to 3.4% saving $600/month; total interest savings projected ~$65,000 over 30 years while keeping flexibility for a future relocation.

Real-Life Examples of Physicians

You’ll find physicians across specialties using doctor loans to match timing to career milestones: a PGY-2 resident closed on a $520,000 condo with 0% down in 30 days, a cardiology fellow bought an $820,000 home with 3% down using stipend-based qualifying, and a new attending refinanced a $600,000 loan to cut payments by $600/month-each case shows how tailored underwriting and waived PMI accelerate ownership.

Lessons Learned from Home Purchases

You should prioritize lender experience with physician loans, verify contract-based income acceptance, and plan for slightly higher initial rates versus down-payment requirements; doing so helped examples above avoid PMI, close faster (30-45 days), and buy earlier in their training paths.

Focus on four practical takeaways: secure a lender familiar with employment-contract verification, get preapproval that factors in future attending salary, compare total cost (rate + PMI avoidance + seller concessions) rather than just rate, and model cash flow for relocation or fellowship changes-these steps reduced upfront costs by $20k-$150k across the cases and preserved mobility while building equity sooner.

Conclusion

To wrap up, doctor mortgage loans let you buy a home sooner by offering low or no down payment options, waived private mortgage insurance, flexible underwriting that considers future physician income and residency contracts, and higher allowable debt ratios so approvals and closings happen faster and you can build equity earlier in your career.